B9 — original pdf

Backup

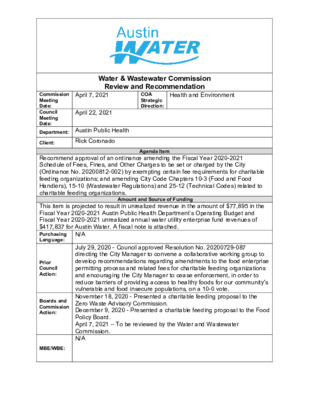

Water & Wastewater Commission Review and Recommendation Health and Environment COA Strategic Direction: April 7, 2021 Commission Meeting Date: Council Meeting Date: Department: Austin Public Health April 22, 2021 Client: Rick Coronado Agenda Item Recommend approval of an ordinance amending the Fiscal Year 2020-2021 Schedule of Fees, Fines, and Other Charges to be set or charged by the City (Ordinance No. 20200812-002) by exempting certain fee requirements for charitable feeding organizations; and amending City Code Chapters 10-3 (Food and Food Handlers), 15-10 (Wastewater Regulations) and 25-12 (Technical Codes) related to charitable feeding organizations. Amount and Source of Funding This item is projected to result in unrealized revenue in the amount of $77,895 in the Fiscal Year 2020-2021 Austin Public Health Department’s Operating Budget and Fiscal Year 2020-2021 unrealized annual water utility enterprise fund revenues of $417,837 for Austin Water. A fiscal note is attached. Purchasing Language: N/A July 29, 2020 - Council approved Resolution No. 20200729-087 directing the City Manager to convene a collaborative working group to develop recommendations regarding amendments to the food enterprise permitting process and related fees for charitable feeding organizations and encouraging the City Manager to cease enforcement, in order to reduce barriers of providing access to healthy foods for our community's vulnerable and food insecure populations, on a 10-0 vote. November 18, 2020 - Presented a charitable feeding proposal to the Zero Waste Advisory Commission. December 9, 2020 - Presented a charitable feeding proposal to the Food Policy Board. April 7, 2021 – To be reviewed by the Water and Wastewater Commission. N/A Prior Council Action: Boards and Commission Action: MBE/WBE: Currently, the City regulates most charitable feeding organizations (CFO) in the same manner as commercial food establishments. Consistent with the policy direction set forth in Resolution No. 20200729-087, staff worked extensively with charitable feeding stakeholders (representatives of the Food Policy Board) and City Departments (Office of Sustainability, Austin Water, Austin Fire, Austin Resource Recovery, Development Services Department) to identify how City regulations, policies and fees can be amended to reduce the barriers of providing access to healthy foods for our community’s vulnerable and food insecure populations. To reduce CFO regulatory requirements without unduly compromising public safety, staff worked with the Office of Sustainability to identify four major types of CFO’s based on food safety risk. Staff then formulated the following recommendations for regulatory and fee changes that are proportionate to the level of food safety risk posed by each CFO category: Category 1 CFO’s are traditional food pantries that distribute only shelf stable foods (canned foods and packaged grains) and uncut produce. Because they pose no significant food safety risk, these CFO’s are not regulated by the City or the State of Texas. ° APH Recommendation: In the absence of permitting, require registration as a Category 1 CFO and best management practices. Routine inspections will not be conducted. ° APH Recommendation: Designate a CFO ombudsman/liaison to assist all CFO’s; and establish a CFO webpage. Category 2 CFO’s distribute and may portion commercially prepared and packaged time-temperature controlled for safety (TCS) foods and therefore pose low-moderate food safety risks. Category 2 CFO’s are defined by the State of Texas as a food establishment. ° APH Recommendation: Amend Chapter 10-3 of the City Code (Food and Food Handlers) to define a Category 2 CFO and exempt it from permitting requirements. In lieu of permitting, require registration of Category 2 CFO’s and best management practices. ° APH Recommendation: Conduct annual inspections (please note that no inspection fee currently exists for unpermitted food establishments and no such fee is recommended). ° APH Recommendation: Designate CFO ombudsman/liaison and establish a CFO webpage. ° AW Recommendation: Exempt Category 2 CFO’s from wastewater discharge permit and surcharge fees. ° AW Recommendation: Amend Chapter 15-10 and 25-12 to exempt new Category 2 CFO’s from the requirement to install grease traps. ° AW Recommendation: Austin Water Director will relax grease trap maintenance requirements on a case-by-case basis. Category 3 CFO’s heat, cool and/or portion commercially prepared foods that are TCS for same day service and therefore pose moderate-significant food safety risks and will require a food establishment permit. A Category 3 CFO is defined by the State of Texas as a food establishment. ° APH Recommendation: Due to pathogen risk, continue requiring food establishment permit. To ease permitting process, amend Chapter 10-3 (Food and Food Handlers) to define CFO Category 3 and reduce certain permitting requirements (e.g., multiple sinks, self-closing doors, smooth ceiling tile surfaces, etc.). ° APH Recommendation: Exempt Category 3 CFO’s from food establishment permit fee. ° APH Recommendation: Designate CFO ombudsman/ liaison; establish a CFO webpage; and consider variances on a case-by-case basis. ° AW Recommendation: For Category 3 CFO’s that have existing grease traps that process minimal amounts grease/ solids, the Austin Water Director will relax grease trap maintenance requirements on a case-by- case basis. ° AW Recommendation: Exempt Category 3 CFO’s from wastewater discharge permit and surcharge fees. Category 4 CFO’s are full-service food charitable feeding establishments, such as community kitchens or soup kitchens, that require food establishment permits. They are defined by the State of Texas as food establishments. ° APH Recommendation: Due to significant pathogen risk, continue requiring food establishment permit and compliance with the Texas Food Establishment Rules. ° APH Recommendation: Exempt Category 4 CFO’s from food establishment permit fee. ° APH Recommendation: Designate CFO ombudsman/ liaison; establish a CFO webpage; and consider site-specific variances. ° AW Recommendation: Exempt Category 4 CFO’s from wastewater discharge permit and surcharge fees. To-date, staff has designated a supervisor-level Environmental Health Services Division ombudsman to work directly with CFO’s on permitting and regulatory matters; drafted best management practices (also known as BMP’s) for CFO’s; and launched a beta version of a CFO webpage linked to the Austin Public Health/Environmental Health Services Division webpage. Resolution No. 20200729-087 also encouraged the City Manager to cease enforcement of structure-based requirements that do not impact life-safety and health until at least December 31, 2020 to avoid losing CFO resources at a time when demand for food access is growing due to COVID-19-related lay-offs. To staff’s knowledge, this has been accomplished to date and staff is not aware of any recent or pending CFO permitting issues. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 ORDINANCE NO. AN ORDINANCE AMENDING THE FISCAL YEAR 2020-2021 SCHEDULE OF FEES, FINES, AND OTHER CHARGES TO BE CHARGED OR SET BY THE CITY (ORDINANCE NO. 20200812-002) TO EXEMPT CHARITABLE FEEDING ORGANIZATIONS FROM THE AUSTIN PUBLIC HEALTH DEPARTMENT’S GENERAL ENVIRONMENT/LICENSING INSPECTIONS FEE AND FOOD ESTABLISHMENT FEE. BE IT ORDAINED BY THE CITY COUNCIL OF THE CITY OF AUSTIN: PART 1. Council amends the Fiscal Year 2020-2021 Schedule of Fees, Fines, and other Charges to be charged or set by the City (Ordinance 20200812-002) to revise the Austin Public Health Department’s fees as set forth in Exhibit A, attached to this ordinance, to exempt charitable feeding organizations from the general environment/licensing inspections fee and food establishment fee. This ordinance takes effect on ____________________2021. PASSED AND APPROVED _________________________, 2021 APPROVED: __________________ Anne L. Morgan City Attorney § § § ______________________________ Steve Adler Mayor ATTEST: _______________________ Jannette S. Goodall City Clerk OPERATING BUDGET FISCAL NOTE DATE OF COUNCIL CONSIDERATION: CONTACT DEPARTMENT(S): FUND: 4/22/21 Austin Public Health General SUBJECT: Approve an ordinance amending the Fiscal Year 2020-2021 the Fiscal Year 2020-2021 Schedule of Fees, Fines, and Other Charges to be set or charged by the City (Ordinance No. 20200812-002) by exempting certain fee requirements for charitable feeding organizations; and amending City Code Chapters 10-3 (Food and Food Handlers), 15-10 (Wastewater Regulations) and 25-12 (Technical Codes) related to charitable feeding organizations. CURRENT YEAR IMPACT: Fees Waived: $37,336 $25,536 $10,217 $3,910 $896 Category 2; 1-25 Employees Category 3; 1-25 Employees Category 4; 1-25 Employees Category 4; 26-50 Employees Category 4; 51+ Employees $77,895 Total Fees Waived Known # CFOs ANALYSIS / ADDITIONAL INFORMATION: This item is projected to result in unrealized revenue in the amount of $77,895 in the Fiscal Year 2020-2021 Austin Public Health Department’s Operating Budget and Fiscal Year 2020-2021 unrealized annual water utility enterprise fund revenues of $417,837 for Austin Water. The City of Austin curently has an estimated 189 charitable feeding organization (CFO) operations that require food establishment permits fees that range from $359 to $896 per establishment per year depending on the establishment size (number of employees) and risk category, as set forth in the Fiscal Year 2020-2021 Schedule of Fees, Fines, and Other Charges (Ordinance No. 20200812-002). Waiving fees or costs for this item results in unrealized revenue for the General Fund. Because budgeted revenue for fees is based upon current counts of establishments requiring permits, the waiver of these fees reduces potential revenues that could otherwise be realized.