B15 — original pdf

Backup

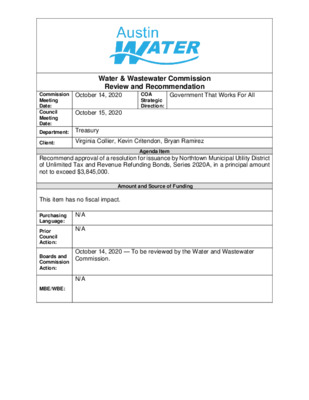

Water & Wastewater Commission Review and Recommendation October 14, 2020 Government That Works For All Commission Meeting Date: Council Meeting Date: Department: Treasury October 15, 2020 COA Strategic Direction: Client: Virginia Collier, Kevin Critendon, Bryan Ramirez Agenda Item Recommend approval of a resolution for issuance by Northtown Municipal Utility District of Unlimited Tax and Revenue Refunding Bonds, Series 2020A, in a principal amount not to exceed $3,845,000. This item has no fiscal impact. Amount and Source of Funding October 14, 2020 — To be reviewed by the Water and Wastewater Commission. Purchasing Language: Prior Council Action: Boards and Commission Action: MBE/WBE: N/A N/A N/A The Northtown Municipal Utility District (the “District”) was created in 1985. At an election held within the District on December 21, 1985, the District’s voters authorized the issuance of an aggregate principal amount of $69,443,000 of unlimited tax and revenue bonds for the construction of the District’s water, sanitary sewer and drainage systems. The District is approximately 1,224 acres and lies just east of Interstate 35 between Austin and Pflugerville. The District includes the Northtown Park, Meadow Pointe, Wildflower, Settler's Meadow (The Trails at Sunset Ridge), The Lakes at Tech Ridge, and Brookfield neighborhoods, an elementary school, several parks and ponds, a hike and bike trail, and other areas. When the District was created, the City of Austin and the District entered into a Consent Agreement. The Consent Agreement provides that the City may annex the District after eight years from the date of confirmation of creation of the District if 90% of the District's facilities that were to be constructed through the issuance of bonds had not been completed by that eight-year timeframe (1993). Because 90% of the District's facilities were not completed eight years after confirmation of creation, the City could technically proceed with annexation of the District at any time. Generally, under Texas law, the City may not annex any land within the District unless it annexes the entire District, assumes all of the District's obligations, including the Bonds, and dissolves the District. At this time, the City has not initiated any discussions and no negotiations on the terms of any possible strategic partnership agreement or on the creation of a limited district have occurred. While the City of Austin is not responsible for the principal and interest payments due on the District’s outstanding debt, Article II, Section A. 1 of the Consent Agreement requires that all bonds the District issues, and the terms and provisions thereof, be approved by the Austin City Council prior to issuance. The City Council last took action in 2019 to approve the District’s refunding of debt originally issued in 2007, 2011 and 2012. Similar to a home refinance, “refunding” of debt lowers the amount of debt service over the life of the existing bonds by replacing them with new bonds that have lower interest costs. At this time, due to favorable market conditions, the District has proposed a refunding bond issue to reduce annual debt service requirements on the District’s debt. Proceeds of the issue will be used to refund and redeem $3,175,000 outstanding Unlimited Tax and Revenue Bonds originally issued in 2011, 2012 and 2014. The net present value savings for this transaction is currently projected to be approximately $136,907.49 or 4.31% of the principal amount of the refunded bonds. The projected present value savings due to the reduced market interest rates meets the City’s target guideline of a 4.25% savings for its own bond refundings. Since the actual amount of savings is dependent on the terms of the sale, approval is requested for this transaction at a minimum present value savings of 4.25%, to allow for market fluctuations. While the City is not responsible for debt service on the District’s Bonds, the City would benefit from the debt service savings associated with the refunding once the District is dissolved. The City’s Financial Services Department and the City’s Financial Advisor have reviewed the proposed refunding and recommend approval of the District’s proposed refunding.