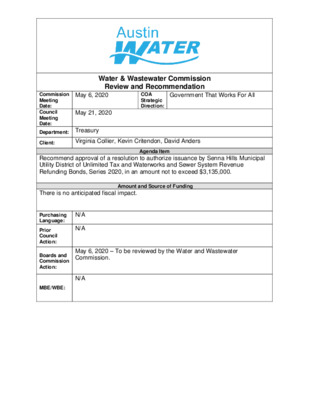

B7 — original pdf

Backup