F.1.0 - 607 Oakland Ave - Tax abatement application_Redacted — original pdf

Backup

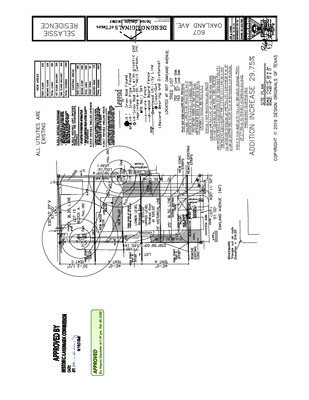

home design center home design center home design center DESIGN ORIGINALSof Texas DESIGN ORIGINALSof Texas DESIGN ORIGINALSof Texas OFFICE (512) 331-1775 AUSTIN, TX. 78726 10713 RR N 620, STE. 412 I I G N C N E F N O T C E T O R P E E R T E D V O R P I E V A H O T S K N U R T D N A S A E R A D E H C L U M R O F , D E D E E N S A , I G N K N A L P E V T C E T O R P I I N A L P E T S E H T N O S E E R T D E T C E T O R P I L A T N E M N O R V N E F O S T N E M E R U Q E R R E P I 2 , 5 , 3 I N O T C E S L A U N A M A R E T R C I I E C N E F K N I L N A H C I H G H I T F 5 A L L A T S N I S E E R T D E T C E T O R P L L A F O Z R C L L U F E H T D N U O R A E E R T E H T N E H W I . E T S E H T O T T N E C A J D A D N A N O Z R C I L L U F E R T N E E H T S S A P M O C N E T O N N A C E C N E F N O T C E T O R P I D N A ) I I M U M N M A T A ( Z R C 2 1 / E H T T C E T O R P T S U M E C N E F E H T " 8 I N A E V E C E R T S U M Z R C L L U F E H T F O S N O T R O P I D E C N E F N U L L A I . N O T C A P M O C / L I O S T O O R T M I L O T I H C L U M D E T C E T O R P F O R E Y A L K N U R T D N U O R A Y E L R U C E S ) N M L L A T T F I ' 6 ( R E B M U L 4 X 2 P A R T S E G A M A D I L A T N E D C C A T N E V E R P O T N A C E P " 7 2 F O I N O T C U R T S N O C T U O H G U O R H T © 0 2 0 2 , 6 0 b e F , m p 7 0 : 1 t a e t t e d u a G a l e g n A y B home design center home design center home design center DESIGN ORIGINALSof Texas DESIGN ORIGINALSof Texas DESIGN ORIGINALSof Texas OFFICE (512) 331-1775 AUSTIN, TX. 78726 10713 RR N 620, STE. 412 © 0 2 0 2 , 6 0 b e F , m p 7 0 : 1 t a e t t e d u a G a l e g n A y B home design center home design center home design center DESIGN ORIGINALSof Texas DESIGN ORIGINALSof Texas DESIGN ORIGINALSof Texas OFFICE (512) 331-1775 AUSTIN, TX. 78726 10713 RR N 620, STE. 412 0 2 0 2 , 6 0 b e F , m p 7 0 : 1 t a e t t e d u a G a l e g n A y B © home design center home design center home design center DESIGN ORIGINALSof Texas DESIGN ORIGINALSof Texas DESIGN ORIGINALSof Texas OFFICE (512) 331-1775 AUSTIN, TX. 78726 10713 RR N 620, STE. 412 © 0 2 0 2 , 6 0 b e F , m p 7 0 : 1 t a e t t e d u a G a l e g n A y B City of Austin Local Historic District Tax Abatement Part I - Application for Certificate of Eligibility Address of property: bo* omrLhv0 M€ , llvsft{ lTN +8 7o3 9 Aoof 16e*[1c.6 Pf+tttt- Name of Local Historic District: I)PContributing property I I trton-contributing property Legal Description of Property: Lori 1 LT 3 brr/ s T6e4t*t (ow Tax Parcel lD Number: Vc 6n zb Appr-rcnrur/PRoJ Ecr Coruracr: N"r", wr,srew s- s€L/6tr6 Mailing Address City, kvsTd ffi;,ta€ ft(uar t" S euw l€ Mailing OwHeR: ku (rl".l state:lc zip: ffi T<l b Telephone: Mobile phone rerephone: Mobile phone: state:If, zip:79 ?V b e^un Proposed Use of the Property: Pu s t bcNTt/Y- of Work: v\) ,/\) a{w 6N UUA{ 6 LrL-tTLtcftz- e rg-s o 9rDt 6\J ^J o oq) Dao & Pht ntr Projected Construction Schedule 5vu ZIZD D{oc(c$ g 6:rL 2'o?\ Has the property received any other property tax relief under $ 11.24 of the Texas Tax Code?: Describe all City Code violations, if any, on the property within the previous five years l\h No For Historic Preservation Office use only: _ Property is not a contributing or potentially contributing structure _ Certificate of Eligibility approved by Historic Landmark Commission _ Certificate of Eligibility p!approved by Historic Landmark Commission Historic Preservation Officer Date City of Austin Application for Historic Area District Tax Abatement Adopted December 2012 City of Austin Local Historic District Tax Abatement Part i‐ Application for Certificate of Eligibility てヽづ EsTIMATE OF ExPENDiTURES PropeКy Address: ぁっ″ つA´ 【とオNも /持 げC「wuヒ ′い゛欝 Proposed Scope of Work W iЩ ttO囃 こ鶴 雛qOゼ とヽもあ 鸞出 出 代waOω Δ 氣 公 Ь。心 AJじU ttυ AJも 祠 Э州 ■ β)′弯 〒ヱAu t^Jt(魯T伽 ∝ Wご ビ騨 う,9ガ N卿 瓜ビー 1磯,DF ЦげォC (T噂 o 名印 に し 小Jじ呵 Cし 謀姉乞rれ A― しし ^Jビ リ (フLuノレtら ′ス」C 郎殉 乙彎f輌睦 つ 孤 θL!η οN∂ F%年 黎 釧 》ど 価 HドME W♪― ‖ 測 “ =ど .) 「 こxと弁1′ 洒 70ガ 午 とPF f ttO夕 て√ suら ―滉 leFぉこご 駒 J′τ 「 ЪAfttЩ 算汀 例距ル う′か′刑 ど 勲デP々r2◆ ′AJぐザー ?/十 1祀 f p♂ T■ 1か どと STЦ こ切 碇 『 傲酌 f◆ ρ加 刺 「 "炒 "炉 てを 7佐,D′ノ測ξ Dゞ′ら′ハJrめ 凛 Estimated Cost =η γЭ3 “ 井π ,θ θ。 撃 う9′ ,つ ∂ #砂コ′′D 攀 qtt θ♂a オ ↓デ′碇効 孝 乙2,っっ∂ キ Jψ.0∂∂ 43務 θω イ ちヵDω 子 raッθ オ 多笏 θ。。 ガ 'テ,0'つ サ lι′99つ サ ク巧 ■ lb′ ο′ρ オ IQ,♂っ 'pο Pre‐ rehabilitation′ restoration value of property: 0/。 of value being spent on rehabilitation′ restoration: 0/O oftotal estimated costs being spent on exterior work: TotaI O鬱ο2ii 寸々qι ,o。 つ 十1?駒r,θ 2ともあ υ午み計厖 Attach additional pages if needed Ctty of Ausun Applicadon for Histonc Area Distnct Tax Abatement Adopted December 2012 Ctty of Austin Local Historic District Tax Abatement Part i‐ Application for Certificate of Eligibility THE STATE OF COUNTY OF し庁 ニ § § STATEMENT OF UNDERSTANDING,AUTHORIZATION FOR INSPECTION OF PROPERTY, AND AFFIDAVIT REGARDING TAXES,FEES,FINES AND PENALTIES Propetty Add Owneド s Name ιOtt D任佐と/加 Δ 脚 Jご AVゴ7∬ × 今忠ヶo= 「 l am over 18 years of age and am competentto sign this Aridavit. l am the owner ofthe propetty identified above. l am seeking a tax abatementforthe propetty identified above. I cettify that the informadon in the applicadon for a tax abatement,including a‖ suppotting documentation〕 is complete and correct. l authorize city otticials to visit and inspect the propeny as necessary to cenify eligibility and verincatiOn for a tax abatement. l acknowiedge thatl have read and understand the program requirements,and thativ胡 li not receive an abatement until a‖ progran∩ requirements have been met and l have obtained a cenincate Of verincadon frOm the Ctty of Ausun. l understand that a‖ rehabilitation work must be completed within 2 years aRerthe date ofthe issuance of a Cettificate of Eligib‖ ity and Cettificate of Appropriateness.If the deadline for completion is subsequently extended by the Historic Landmark Conlmission a‖ rehabilitation work must be completed by the extended time specified.l understand that penalties may apply ifl do not complete the work as proposed and approved by the Historic Landmark Commission. l amrm thatimprovements wili comply with the historic area combining district PreseⅣ ation PIan and Design Standards. l understand thati must make an application to Travis County Appraisal District each year in orderto receive the abatement forthat year,and thatifi do not make the application in time, I wi‖ lose the ab‖ ity to receive a tax abatementforthat year. AIl propetty taxes are currentt and no City of Austin fees,fines or penalties a property or any propetty owned by a busi in an re owed,on the ownership interest. Signature ルD多 I Date l declare under penalty of pettury that the statements above are true and correct. 刷堅 習: ・ by the ttd _〕 2r ,to ce苗,whに h Witnc に 「 ERICA A DONEGAN Notary Public′ State of Comm Expires 02‐ 18‐ 2024 Notary ID 132362842 Notary Public,State of My commission expires CК y of Ausun ApplicattOn for Histonc Area District Tax Abatement Adopted December 2012