F.1.0 - 1910 Maple Ave - Tax Abatement Application — original pdf

Backup

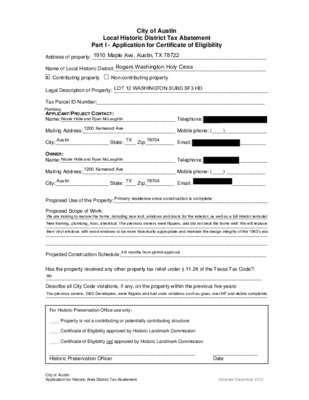

City of Austin Local Historic District Tax Abatement Part I - Application for Certificate of Eligibility Address of property: ______________________________________________________________ Name of Local Historic District:______________________________________________________ (cid:0) Contributing property (cid:0) Non-contributing property Legal Description of Property: _______________________________________________________ Tax Parcel ID Number:____________________________________________________________ APPLICANT/PROJECT CONTACT: Name:_________________________________________ Telephone: Mailing Address:_________________________________ Mobile phone: (____)_______________ City:___________________ State: ____ Zip:__________ Email: OWNER: Name:_________________________________________ Telephone: Mailing Address:_________________________________ Mobile phone: (____) ______________ City:___________________ State: ____ Zip:__________ Email: Proposed Use of the Property:_______________________________________________________ Proposed Scope of Work: _______________________________________________________________________________ ____________ __________ _________ _______________________________________________________________________________ _______________________________________________________________________________ _______________________________________________________________________________ Projected Construction Schedule:____________________________________________________ Has the property received any other property tax relief under § 11.24 of the Texas Tax Code?: _____________________________________________________________________________ Describe all City Code violations, if any, on the property within the previous five years: _______________________________________________________________________________ For Historic Preservation Office use only: ____ Property is not a contributing or potentially contributing structure ____ Certificate of Eligibility approved by Historic Landmark Commission ____ Certificate of Eligibility not approved by Historic Landmark Commission ____________________________________________________ Historic Preservation Officer ________________ Date City of Austin Application for Historic Area District Tax Abatement Adopted December 2012 1910 Maple Ave, Austin, TX 78722Rogers Washington Holy Cross xNicole Holle and Ryan McLaughlinAustin1200 Kenwood AveTX78704Nicole Holle and Ryan McLaughlin1200 Kenwood AveAustinTX78704Primary residence once construction is completeWe are looking to restore the home, including new roof, windows and doors for the exterior, as well as a full interior remodel.noThe previous owners, D&O Developers, were flippers and had code violations such as grass over 48" and debris complaints. Plumbing4-6 months from permit approvalNew framing, plumbing, hvac, electrical. The previous owners were flippers, and did not treat the home well. We will replace their vinyl windows with wood windows to be more historically appropriate and maintain the design integrity of the 1960's era.LOT 12 WASHINGTON SUBD SF3 HD City of Austin Local Historic District Tax Abatement Part I - Application for Certificate of Eligibility ESTIMATE OF EXPENDITURES Property Address: Proposed Scope of Work Estimated Cost Total: Pre-rehabilitation/restoration value of property: % of value being spent on rehabilitation/restoration: % of total estimated costs being spent on exterior work: Attach additional pages if needed. City of Austin Application for Historic Area District Tax Abatement Adopted December 2012 Framing labor$11,000Framing materials$7,500$16,000Electrical$12,500HVAC$9,500Window installation$4,000Windows$16,000Front door$2,000Back door$1,000Insulation$7,500Drywall materials$3,500Drywall installation$12,000Flooring materials$6,500Flooring installation$4,800Floor leveling$3,900Interior doors$2,000Trim materials$2,600$5,000Foundation repairMasonry repair$5,000Roofing$5,500Type text here91.3%22%$137,800$150,814 (per TCAD) for improvementsPlumbing City of Austin Local Historic District Tax Abatement Part I - Application for Certificate of Eligibility THE STATE OF _________________ § COUNTY OF ___________________ § STATEMENT OF UNDERSTANDING, AUTHORIZATION FOR INSPECTION OF PROPERTY, AND AFFIDAVIT REGARDING TAXES, FEES, FINES AND PENALTIES Property Address:_______________________________________________________________ Owner’s Name:_________________________________________________________________ I am over 18 years of age and am competent to sign this Affidavit. I am the owner of the property identified above. I am seeking a tax abatement for the property identified above. I certify that the information in the application for a tax abatement, including all supporting documentation, is complete and correct. I authorize city officials to visit and inspect the property as necessary to certify eligibility and verification for a tax abatement. I acknowledge that I have read and understand the program requirements, and that I will not receive an abatement until all program requirements have been met and I have obtained a certificate of verification from the City of Austin. I understand that all rehabilitation work must be completed within 2 years after the date of the issuance of a Certificate of Eligibility and Certificate of Appropriateness. If the deadline for completion is subsequently extended by the Historic Landmark Commission all rehabilitation work must be completed by the extended time specified. I understand that penalties may apply if I do not complete the work as proposed and approved by the Historic Landmark Commission. I affirm that improvements will comply with the historic area combining district Preservation Plan and Design Standards. I understand that I must make an application to Travis County Appraisal District each year in order to receive the abatement for that year, and that if I do not make the application in time, I will lose the ability to receive a tax abatement for that year. All property taxes are current, and no City of Austin fees, fines or penalties are owed, on the property or any property owned by a business association in which I have an ownership interest. Signature _________________________________________________ Date Owner/Applicant I declare under penalty of perjury that the statements above are true and correct. Subscribed and sworn to before me, by the said ____________________________________, this the ______ day of _____________, ______, to certify which witness my hand and seal of office. __________________________________________________ Notary Public, State of _______________________________ My commission expires ______________________________ City of Austin Application for Historic Area District Tax Abatement Adopted December 2012 TexasTravis1910 Maple Ave, Austin, TX 78722Nicole Holle and Ryan McLaughlinyes 3/31/2021 Travis CAD Travis CAD - Property Details Property Search Results > 204123 D&O DEVELOPERS LLC for Year 2021 Tax Year: 2021 - Values not available Legal Description: LOT 12 WASHINGTON SUBD Zoning: Agent Code: SF3 Property Account Property ID: Geographic ID: Type: Property Use Code: Property Use Description: 204123 0212101514 Real Protest Protest Status: Informal Date: Formal Date: Location Address: Neighborhood: Neighborhood CD: Owner Name: Mailing Address: Values 1910 MAPLE AVE TX 78722 SEGMENTED D2009 Mapsco: Map ID: 021011 D&O DEVELOPERS LLC 7419 QUAIL RUN DR SAN ANTONIO, TX 78209-3128 Owner ID: % Ownership: 1811231 100.0000000000% Exemptions: (+) Improvement Homesite Value: + (+) Improvement Non-Homesite Value: + + (+) Land Homesite Value: + (+) Land Non-Homesite Value: + (+) Agricultural Market Valuation: + (+) Timber Market Valuation: N/A N/A N/A N/A Ag / Timber Use Value N/A N/A N/A N/A -------------------------- propaccess.traviscad.org/clientdb/Property.aspx?cid=1&prop_id=204123&year=2021 1/3 3/31/2021 Travis CAD - Property Details (=) Market Value: = (–) Ag or Timber Use Value Reduction: – = (=) Appraised Value: – (–) HS Cap: = (=) Assessed Value: -------------------------- -------------------------- N/A N/A N/A N/A N/A Taxing Jurisdiction Owner: % Ownership: 100.0000000000% N/A Total Value: D&O DEVELOPERS LLC Tax Rate Appraised Value N/A N/A AUSTIN ISD N/A N/A CITY OF AUSTIN N/A N/A TRAVIS COUNTY N/A N/A TRAVIS CENTRAL APP DIST N/A N/A TRAVIS COUNTY HEALTHCARE DISTRICT N/A AUSTIN COMM COLL DIST N/A HOMESTEAD PRESERVATION REINVESTMENT ZONE 1 N/A N/A N/A Total Tax Rate: Entity Description 01 02 03 0A 2J 68 HPR1 N/A N/A N/A N/A N/A N/A N/A Taxable Value Estimated Tax N/A N/A N/A N/A N/A N/A N/A N/A N/A Taxes w/Current Exemptions: Taxes w/o Exemptions: 1 FAM DWELLING State Code: A1 Living Area: 1696.0 sqft Value: N/A Improvement / Building Improvement #1: Type Description Class CD R5 - * 1st Floor R5 - * PORCH OPEN 1ST F R5 - * HVAC RESIDENTIAL R5 - * FIREPLACE R5 - * STORAGE ATT TERRACE UNCOVERD R5 - * R5 - * BEDROOMS 1ST 011 095 522 581 612 252 Exterior Wall Year Built 1964 1964 1964 1964 1964 1964 1964 SQFT 1696.0 66.0 1696.0 1.0 48.0 99.0 4.0 propaccess.traviscad.org/clientdb/Property.aspx?cid=1&prop_id=204123&year=2021 2/3 251 BATHROOM R5 - * 1964 2.0 Travis CAD - Property Details 3/31/2021 Land # Type Description Acres Sqft 1 LAND Land 0.1824 7945.02 0.00 Eff Front Eff Depth Market Value Prod. Value N/A 0.00 N/A Roll Value History Improvements Year 2021 2020 2019 2018 2017 2016 N/A $150,814 $201,147 $173,463 $229,564 $250,513 Land Market N/A $275,000 $275,000 $275,000 $200,000 $200,000 Ag Valuation N/A 0 0 0 0 0 Appraised N/A 425,814 476,147 448,463 429,564 450,513 HS Cap N/A $0 $0 $0 $0 $105,947 Assessed N/A $425,814 $476,147 $448,463 $429,564 $344,566 Deed History - (Last 3 Deed Transactions) # Deed Date Type Description WD 1 7/12/2019 WARRANTY DEED TEXAS Grantor 2 7/12/2019 WD 3 10/2/2016 MS CAPITOL LLC WARRANTY DEED HARRIS TIFFANY MARIE MISCELLANEOUS JONES MABEL JACKSON & Grantee D&O DEVELOPERS LLC TEXAS CAPITOL LLC HARRIS TIFFANY MARIE Volume Page Deed Number 2019105107 2019105102 2016158577 Questions Please Call (512) 834-9317 This site requires cookies to be enabled in your browser settings. Website version: 1.2.2.30 Database last updated on: 3/31/2021 2:32 AM © N. Harris Computer Corporation This year is not certified and ALL values will be represented with "N/A". propaccess.traviscad.org/clientdb/Property.aspx?cid=1&prop_id=204123&year=2021 3/3