Item 1: Draft Austin Energy’s Resource, Generation, and Climate Protection Plan Part 2 of 4 — original pdf

Backup

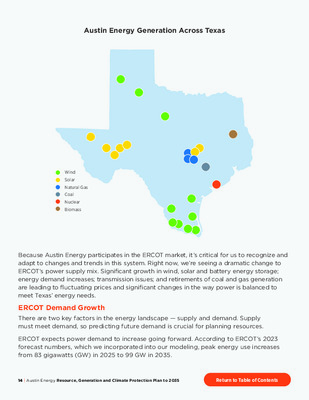

Austin Energy Generation Across Texas Wind Solar Natural Gas Coal Nuclear Biomass Because Austin Energy participates in the ERCOT market, it’s critical for us to recognize and adapt to changes and trends in this system. Right now, we’re seeing a dramatic change to ERCOT’s power supply mix. Significant growth in wind, solar and battery energy storage; energy demand increases; transmission issues; and retirements of coal and gas generation are leading to fluctuating prices and significant changes in the way power is balanced to meet Texas’ energy needs. ERCOT Demand Growth There are two key factors in the energy landscape — supply and demand. Supply must meet demand, so predicting future demand is crucial for planning resources. ERCOT expects power demand to increase going forward. According to ERCOT’s 2023 forecast numbers, which we incorporated into our modeling, peak energy use increases from 83 gigawatts (GW) in 2025 to 99 GW in 2035. 14 | Austin Energy Resource, Generation and Climate Protection Plan to 2035 Return to Table of Contents Predicting future demand helps ERCOT plan how to meet the growing needs of the system. For Austin Energy, this helps us better understand the market while we outline future resource strategies to meet our customer and system needs. New Generation and Retirements in ERCOT On the supply side of the energy equation is generation. ERCOT expects significant growth in this area as well. Following the national trend, many of these proposed new generation projects in ERCOT are renewable energy sources. While these sources provide clean energy, their weather-dependent nature has led to growing operational and reliability risks. Meanwhile, a significant portion of older power plants in the ERCOT market are nearing the end of their operational life. ERCOT also manages retirements to ensure grid reliability, potentially intervening to keep critical plants online when absolutely necessary. As ERCOT works to balance supply and demand on the statewide system, it’s important for Austin Energy to factor that information into our resource planning. The 2035 Plan incorporates the most up-to-date, official information related to announced plant additions and retirements from ERCOT. This gives us one look to the future for the modeling process. ERCOT and Transmission Congestion Because many new generation sources are located far from the end users, ERCOT is seeing a significant increase in transmission congestion. When transmission lines need to transport more power than they can carry, they can become overloaded, causing congestion. ERCOT creates Generic Transmission Constraints (GTC) to manage the flow of power over a group of transmission lines or equipment. Normally, transmission constraints are based on the safe operating temperature of transmission lines, as more power flowing through equipment increases heat. Overloading could break the equipment or cause it to fail. There are 23 GTCs in ERCOT’s system. Though GTCs help prevent equipment failure, they also limit the amount of power that can be transported. That limit can cause prices to increase, making power more expensive. When planning future resources and their locations, Austin Energy must consider all these details to protect customers from market costs and an evolving system. 14 | Austin Energy Resource, Generation and Climate Protection Plan to 2035 Return to Table of Contents Austin Energy Resource, Generation and Climate Protection Plan to 2035 | 15 WEBBER ENERGY GROUP’S VIEW OF THE ENERGY LANDSCAPE Finding other knowledgeable perspectives and insights helps focus the picture of the challenges we need to address in resource planning. To expand our scope and knowledge, Austin Energy partnered with the Webber Energy Group to give us its analysis of trends in the energy industry. The Webber Energy Group is an energy research team out of the University of Texas at Austin. They focus on bringing scientific methodology and technical expertise to issues around energy and the environment, all to help reach a more sustainable path. For the 2035 Plan, the Webber Energy Group looked at the drivers of increasing power demand, the need for more power generation because of that increase and the challenges of decarbonization while addressing those needs. Here’s a summary of their considerations: 16 | Austin Energy Resource, Generation and Climate Protection Plan to 2035 Return to Table of Contents Page from of Webber Energy Group Report Considerations for the Austin Energy Resource, Generation and Climate Protection Plan to 2035 Emily Arnim, Dr. Yael R. Glazer, & Dr. Michael E. Webber October 2024 Executive Summary This report examines how Austin Energy (AE) can manage increasing electricity demand through 2040 while ensuring clean, reliable, and affordable power. With AE peak demand projected to reach up to 7,800 MW by 2040 under a high load growth scenario—from about 3,000 MW in 2023—the utility faces the multi-pronged challenge of expanding and decarbonizing its energy supply while operating in a warming world. AE must address the expiration of renewable power purchase agreements (PPAs) and rising power demand driven by four main factors: population and economic growth; electrification of home heating and cooking; large load growth (e.g., data center growth); and electric vehicle (EV) adoption. Our analysis identifies unmanaged EV charging as the most significant driver of peak demand growth. If EV charging remains unmanaged, it could account for nearly half of the total peak load. Smart-charging technologies will be a crucial component of AE’s resource plan, with the potential to shave 3,600 MW off of peak demand. Data centers could also emerge as drivers of peak demand growth, though their individual power requirements are uncertain. Data center expansion will therefore necessitate careful monitoring and adaptable strategies from AE. To effectively meet future demand, AE must evaluate options through the lens of trade-offs, considering a diverse range of supply and demand solutions that ensure resource adequacy and reliability while minimizing pollution and mitigating exposure to price volatility and transmission congestion fees. Key strategies might include: enhancing energy efficiency; expanding renewable energy sources; deploying distributed solutions such as solar, energy storage, and demand response; and installing dispatchable power sources in the AE service area—with a preference for carbon-free options. In addition, short-term solutions might need to be incorporated as part of the plan to ensure resource adequacy despite import capacity limitations and the retirement of local generation. Additionally, addressing equity and environmental concerns, such as reducing fenceline pollution and outages that disproportionately affect marginalized communities, will also play a vital role in optimizing overall system performance and achieving AE’s sustainability goals. With technologies available today and on the near-term horizon, a balanced mix of carbon-neutral and carbon-free solutions often proves cheaper, faster, and more equitable to implement than solely zero-carbon options. Policymakers reviewing AE’s resource generation plan should recognize the need to balance affordability, reliability, and environmental goals. Effective policies will avoid prescriptive mandates and instead set outcome-based standards, allowing AE flexibility to meet targets while accommodating the potential to integrate innovative solutions in the future. This approach enables AE to pursue emissions reductions and reliability improvements while managing costs, creating an adaptable path forward that minimizes unintended consequences—like cost spikes or reliability concerns—that rigid mandates might cause. Standards-based policies thus support AE’s ability to innovate in its resource planning, meeting community and environmental goals amid shifting energy demands and technologies. Considerations for the Austin Energy Resource, Generation and Climate Protection Plan to 2035 2 © University of Texas at Austin / Webber Energy Group 16 | Austin Energy Resource, Generation and Climate Protection Plan to 2035 Return to Table of Contents Austin Energy Resource, Generation and Climate Protection Plan to 2035 | 17 AUSTIN ENERGY’S ENERGY LANDSCAPE As we’re looking at the broader system and industry, it’s just as important to map our local energy landscape. Demand Growth Just as demand for electricity is growing across the state, Austin Energy has seen local demand increase as well. In the summer of 2024, Austin Energy hit a new peak demand of 3,135 MW. It’s not just summer demand we have to plan for anymore. Our winter peak continues to rise. In January 2024, Austin Energy’s winter peak topped out at 2,708 MW. Three years ago, we had a similar summer peak, around 2,663 MW. Going forward, because of weather predictions, population increases and electrification, we expect demand to grow year over year. To meet that growth, Austin Energy must build out and upgrade our electric system to handle more people and more power, and we have to make sure we can generate or purchase all the power customers need. Planning for those types of differences helps protect our customers during any season. Reliability Reliability is a core value of the community and a key tenet of Austin Energy’s mission. We work 24/7 to provide reliable power to our customers. When the power goes out, there is a reliability issue somewhere. This could be due to distribution or generation issues. Distribution reliability risk relates to impacts to the actual wires and equipment that carry power directly to customers’ homes. The 2035 Plan addresses generation reliability risk, which focuses on having enough power and voltage support to meet customer needs. From a statewide perspective, during Winter Storm Uri in 2021, there wasn’t enough power generated on the ERCOT grid for everyone who needed it. ERCOT had to call for customer outages all across the state in order to prevent a total black out. This weather event also had significant financial impacts for utilities in Texas, adding a financial component to reliably providing power and serving customers. There are more details on the financial impact of extreme weather below. From a local perspective, a critical part of generating and transporting power is voltage, and there has to be enough voltage support to push that power across the system to where the customers are. Not having enough voltage support results in local power outages. With recent generation retirements in our service area, Austin Energy needs additional tools to make sure we have enough voltage support to send that power across our system, especially as customer needs continue to grow. There are more details on generation retirements and voltage support below. 18 | Austin Energy Resource, Generation and Climate Protection Plan to 2035 Return to Table of Contents Generation resource planning doesn’t address every aspect of reliability. The 2035 Plan addresses generation reliability risks and can protect customers by providing us the ability to add the resources we need to address voltage support, extreme weather and market risk. This way, our community is better protected from local outages and future weather events. It would be irresponsible for us not to plan and prepare for these risks. Generation Retirements In support of our clean energy and environmental efforts, Austin Energy evaluates our carbon-generating resources for need and efficiency. In the previous resource plan, we committed to retiring our two steam generators at Decker Creek Power Station. These were old units from the 1970’s. They weren’t as efficient, and maintenance was an increasing challenge. Like a vintage car, parts weren’t always available, and repairs were expensive. It was time for these units to retire. Decker Steam Unit 1 was 300 MW and retired in September 2020. Decker Steam Unit 2 was 425 MW and retired in March 2022. Around this time, transmission congestion across ERCOT was on the rise. In the summer of 2022, Austin Energy’s service area saw a significant increase in load zone price separation, leading to congestion costs exceeding $135 million. In 2023, congestion costs exceeded $150 million. Those costs are three times higher than what we saw before 2022. (There’s more on congestion and load zone price separation in the section below). Austin Energy must address these issues as we continue to analyze our local resources and community needs. Austin Energy is also a partial owner with the Lower Colorado River Authority of the Fayette Power Project coal plant. We know the biggest barrier to our clean energy goals comes from this resource. Though we planned to retire our share of FPP by 2022, we were unable to reach a workable and affordable agreement with our partner. As we continue to work toward that goal, we must also consider how ceasing operations adds new financial and market risks and make a plan to mitigate those risks. Environmental Leadership Austin Energy has a long history of clean energy and environmental investments. In 1995, we purchased power from the first commercial wind farm in Texas, and in 2011, we did the same with the first utility–scale solar farm in Texas. Essentially, our commitment to clean energy helped start the wind and solar power industry in the state. In addition, we help our customers take their own environmental actions through numerous energy efficiency, demand response, local solar, green energy and electric transportation programs. These efforts and more have made Austin Energy an industry leader in conservation and clean energy while helping reach the City of Austin’s goals in the Climate Equity Plan. 18 | Austin Energy Resource, Generation and Climate Protection Plan to 2035 Return to Table of Contents Austin Energy Resource, Generation and Climate Protection Plan to 2035 | 19 Today, 70% of the power we produce and contract for is carbon-free energy as a percentage of load, and we have more than 2,800 MW of renewable power in our generation mix. Power Supply Portfolio in Megawatts Generation Supply Capacity Wind 1795.64 MW Solar 975.6 MW Natural Gas 770 MW Coal 600 MW Nuclear 420 MW Biomass 105 MW Storage 3 MW Wind Austin Energy’s Carbon-Free Energy as a Percentage of Load 77% 72% 70% 63% 63% 66% 60% 54% 40 49% 100 80 60 20 0 2015 2016 2017 2018 2019 2020 2021 2022 2023 Much of this progress comes from our power agreements with renewable resources far from our service area. Here’s how our investments compare to the overall ERCOT generation mix. 20 | Austin Energy Resource, Generation and Climate Protection Plan to 2035 Return to Table of Contents Highlight of Renewable Power Generated by Austin Energy and ERCOT in 2023 Austin Energy Biomass 50% Renewable Power Coal Gas Wind Solar Nuclear Nuclear ERCOT Biomass Coal 41% Renewable Power Gas Wind Solar As renewable resources continue to increase in the ERCOT system, we’re seeing new operational challenges. One example is curtailment for these resources when too much power is produced and the system can’t handle it. This makes that resource less valuable to our customers. Austin Energy will continue our leadership in this area, finding creative ways to reduce the effects of climate change and provide an equitable clean energy transition. Transmission Congestion and Load Zone Price Separation As demand grows, Austin Energy has to make sure we can serve our customers. We can do this by having local sources of supply or by bringing in more power. However, there are limitations on the transmission system that imports power into Austin Energy’s service area — or load zone — in extreme conditions. If you think of transmission lines like straws, there’s only so much electricity that can flow through. If the need for power is greater than what can be provided locally plus what we can bring in, it causes load zone price separation and could lead to local outages. Load zone price separation is when we pay more for the power serving our area than we get generating power in other areas of Texas. There are several causes behind load zone price separation, including congestion, too little local power, transmission outages and even generation and transmission events outside our service area. 20 | Austin Energy Resource, Generation and Climate Protection Plan to 2035 Return to Table of Contents Austin Energy Resource, Generation and Climate Protection Plan to 2035 | 21 ERCOT Real-Time Pricing Heat Map 5:35 p.m. — Aug. 21, 2024 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 5,000.00 3,000.00 2,000.00 1,000.00 500.00 250.00 200.00 190.00 180.00 170.00 160.00 150.00 140.00 130.00 120.00 110.00 100.00 90.00 80.00 70.00 60.00 50.00 40.00 30.00 20.00 10.00 0.00 -10.00 -20.00 -30.00 -40.00 -50.00 -100.00 -250.00 This map from ERCOT’s website shows real-time electricity prices at different nodes across the market on the afternoon of Aug. 21, 2024. The bright red spot over Travis County shows an example of load zone price separation, as the local prices were much higher than much of the rest of the state. 22 | Austin Energy Resource, Generation and Climate Protection Plan to 2035 Return to Table of Contents When there is high demand in the Austin area, transmission lines bringing power in can reach their limit. The ERCOT market recognizes this issue and raises the price of electricity in the Austin Energy service area — signaling that more nearby generation is needed. Depending on the severity and number of price separation events, Austin Energy can end up paying hundreds of millions of dollars more per year to buy power for the Austin area than we earn selling power into the ERCOT market. These events can have significant impacts on customer costs. ERCOT System-Wide Prices Aug. 21, 2024 $1,250 $1,000 $750 $500 $250 $0 00 04 08 12 16 20 24 Day-Ahead Hub Avg. Day-Ahead LZ AEN Real-Time Hub Avg. Real-Time LZ AEN Also from ERCOT’s website, the graph above shows the real-time electricity prices over the course of the day on Aug. 21, 2024. This graph shows load zone price separation for several hours when the blue line (Austin Energy’s load zone) was approximately $1,000 per megawatt-hour (MWh) higher than the yellow line (ERCOT’s average price). Simply stated, Austin Energy was paying about $1,100 per MWh to serve its customers locally, but it was receiving, on average, about $100 per MWh to generate electricity across the state to sell into the ERCOT market. The difference results in significant costs to Austin Energy customers. Load zone price separation creates an affordability risk, and it’s a sign of significant outage risk — all issues we must address. 22 | Austin Energy Resource, Generation and Climate Protection Plan to 2035 Return to Table of Contents Austin Energy Resource, Generation and Climate Protection Plan to 2035 | 23 Austin Energy’s Transmission Transmission system changes are also an important factor in resource planning, especially when local congestion and load zone price separation are growing concerns. 1898 & Co. Transmission Study With direction from the previous resource plan, Austin Energy hired 1898 & Co. to conduct a transmission study that analyzed what would happen to our transmission system if we retired our local natural gas resources at Sand Hill and Decker in 2029. Their results showed that without enough local generation, significant overloading and voltage stability issues occur when those plants shut down. An electric grid with these issues is unreliable and must be addressed to ensure we can get power to customers. There’s more on voltage stability in a section below. The next piece of the study looked at potential projects to address those issues. While the study reviewed eight solutions, no single transmission project studied fully solved the issues. In the end, the study showed that retiring all local power plants in 2029 would create significant reliability issues, putting the community and electric grid at risk. The completion of this transmission study kicked off the 2035 Plan effort. Moving Forward with Transmission Though there wasn’t a single remedy out of 1898 & Co.’s study, Austin Energy found benefits in moving forward with several projects. These are multi-year projects to increase reliability and import capacity, and we have incorporated them into our current Capital Improvement Plan. The timeline for transmission projects can be complicated, though. Some of these projects, depending on the total cost and location, go beyond Austin Energy’s control. They require reviews through the ERCOT Regional Planning Group and potentially require a Certificate of Convenience and Necessity through the Public Utility Commission of Texas. Reviews alone could add two years to a project’s timeline. 24 | Austin Energy Resource, Generation and Climate Protection Plan to 2035 Return to Table of Contents That’s in addition to other timing challenges like industry-wide supply chain issues for transmission equipment and outage approvals and scheduling with ERCOT. Again, Austin Energy is already moving forward on several transmission projects, including adding new lines and substations and upgrading transformers and existing lines. We also continue to assess new projects and system needs through our annual transmission planning assessments, which include the latest forecasts and information from ERCOT. Though transmission projects alone won’t solve all the challenges we’re seeing in our energy landscape, we know they are an important piece of this puzzle and include them in our resource modeling. Voltage Support As we bring power into the Austin area, voltage support is critical in providing reliable service to customers. Think of it like water pressure. It “pushes” the power through the lines, and higher “pressures” push that power farther. Once power gets to Austin Energy’s service area, we have to take it and push it across our area to customers. When power demand in our service area swings significantly or there are issues with getting power into our area from the ERCOT system, there can be voltage concerns. Without enough voltage support, this could lead to local outages and equipment damage. Austin Energy must continuously manage voltage on the local transmission and distribution systems to ensure reliable power. There are several ways to do this. One of the main ways Austin Energy does this is with our local power resources at Sand Hill and Decker. Those are considered spinning generators because they rotate a turbine to produce power. When it comes to voltage support, local spinning generation can increase or lower voltage and provide overall stability through the machinery. There are other potential sources of voltage support, but existing generation has the additional benefit of also providing power. As more people move to Austin, Austin Energy must ensure that we have the equipment and system to reliably provide them with power. Financial Impact of Extreme Weather We’re experiencing more extreme weather events. According to the National Oceanic and Atmospheric Administration’s website, climate.gov, Texas has had some of the greatest total financial impacts from billion-dollar extreme weather events since 1980. In 2023 alone, the state had at least four such events. Along with the physical damage extreme weather causes, liquidity is another significant risk. Liquidity refers to the cash on hand that organizations need to pay their obligations. As a part of ERCOT, Austin Energy is required to have enough cash for its market operations and market exposure. When Austin Energy purchases power from the ERCOT market, payment is due within seven days. But it can be months before we can replenish those reserves from customer payments. That gap is a liquidity risk. 24 | Austin Energy Resource, Generation and Climate Protection Plan to 2035 Return to Table of Contents Austin Energy Resource, Generation and Climate Protection Plan to 2035 | 25 An extreme example of this risk is February 2021 and Winter Storm Uri. After that storm, Brazos Electric Cooperative could not make their required payments to ERCOT. Due to the market conditions and the composition of its generation portfolio at that time, Brazos incurred $1.8 billion in ERCOT costs in just a few days. Brazos was unable to pay that amount, and the utility declared bankruptcy. Brazos was restructured by its stakeholders, and it no longer generates power in the ERCOT market. For Austin Energy, wholesale power costs soared to $1.7 billion during the six days from Feb. 14 to Feb. 19, 2023. That’s roughly equivalent to four years of total load cost under normal conditions for us. Our generation revenue, though, more than offset these costs, leaving roughly $100 million in net revenue that we gave back to our customers. Without that generation, Austin Energy would have had to pay a very high cost for that power in a very short amount of time. If we can’t pay our obligations, it could hurt our financial agreements with all of our suppliers, lower our bond rating and affect the City’s ability to own and operate a municipal utility. More extreme weather makes this a bigger concern. Austin Energy must account for these events in our planning so we can remain financially stable and contribute to the reliability of the ERCOT system. Understanding risks in our energy landscapes tells us what we need to address to protect our customers and community. The path forward starts here. 26 | Austin Energy Resource, Generation and Climate Protection Plan to 2035 Return to Table of Contents I N O T A R E N E G , E C R U O S E R Y G R E N E N T S U A I I 5 3 0 2 O T N A L P N O T C E T O R P E T A M L C D N A I 26 | Austin Energy Resource, Generation and Climate Protection Plan to 2035 Return to Table of Contents Austin Energy Resource, Generation and Climate Protection Plan to 2035 | 27 PARTICIPANTS SURVEY DATES PUBLIC MEETINGS 7,512 8/22–9/29/2023 4 GUIDING LIGHT AUSTIN ENERGY REFLECTS THE VALUES OF ITS COMMUNITY Incorporating the community’s values into our work and operations is the essence of a public power utility. In developing the 2035 Plan, it was crucial for Austin Energy to collaborate with our community and stakeholders. We worked together with a broad range of community members and listened to diverse voices to gather insights, values and priorities. Our collaboration efforts included formal City of Austin commissions as well as facilitated community workshops. The community we serve is the heart of Austin Energy. Their needs and expectations guide our operations. By building the 2035 Plan together, we ensure those values are reflected and our risks reduced in our path to the future. COLLABORATION Public Involvement — Community engagement for this project started in August 2023, focusing on gathering the public’s high-level priorities. We held four public meetings and heard from a wide range of customers, including residential, small businesses, mid-sized businesses and large industrial customers. We also created a webpage and reached out to customers through emails, traditional media and social media to tell them about the opportunity to help shape this plan. In addition, we distributed a survey to gather all of this valuable input. 28 | Austin Energy Resource, Generation and Climate Protection Plan to 2035 Return to Table of Contents Key Results from Resource Generation Survey PARTICIPANTS 7,512 SURVEY DATES 8/22–9/29/2023 PUBLIC MEETINGS 4 Customer Type: 6,355 Customer Type: Residential Customer Type: Business Customer Type: Other Interest (not an Austin Energy customer) Customer Type: Nonprofit/Government Top three ranked values: % of respondents who ranked each item as #1 Reliability: Power is generated from resilient sources that can operate in a variety of conditions. *Affordability: Power costs are kept as low as possible for customers. Environmental Sustainability: Power is generated with a reduced carbon footprint. *Although Affordability and Environmental Sustainability tied in #1 rankings, Affordability received more overall votes. Themes identified from comments related to Resource Generation Planning Comments on Reliability: Diversify supply and use energy sources that are most reliable during extreme weather, coal, gas, nuclear, less renewables, build more power plants. Comments on Environmental Sustainability: No coal, close Fayette, more renewables, more solar, more wind, no nuclear, environment is a priority, reduce fossil fuels. Comments on Affordability: Keep costs low, prioritize affordability. 175 24 22 38% 28% 28% 910 468 394 28 | Austin Energy Resource, Generation and Climate Protection Plan to 2035 Return to Table of Contents Austin Energy Resource, Generation and Climate Protection Plan to 2035 | 29 Stakeholder Workshops — Austin Energy partnered with public involvement and community relations firm Rifeline to get a deeper understanding of our community and their values. Through five stakeholder workshops held from June to November 2024, more than 40 participants from diverse backgrounds representing thousands of Austinites provided their perspectives on values, challenges and objectives for the 2035 Plan. Logos of the Various Groups that Participated in the Stakeholder Workshops Here are high-level summaries for each of the workshops: • Workshop #1 — Community Values The first stakeholder workshop explored the community’s values and priorities as part of the 2035 Plan. As a baseline, this workshop covered the basics around Austin Energy’s mission, how the utility works as a public power electric provider, the Texas energy market and what a resource plan covers. With that introduction, the stakeholders broke into small groups to discuss how their values could be reflected in the 2035 Plan. Here are some highlights of the top themes: » Equity — Ensuring services to those who need them most. » Collaboration — It is important to collect community feedback and foster coordination with local organizations and groups. » Transparency — Information should be easily accessible. » Sustainability and Innovation — Flexibility should be prioritized over specificity, and the 2035 Plan should consider a holistic view of resources when it comes to sustainability. 30 | Austin Energy Resource, Generation and Climate Protection Plan to 2035 Return to Table of Contents