Backup — original pdf

Backup

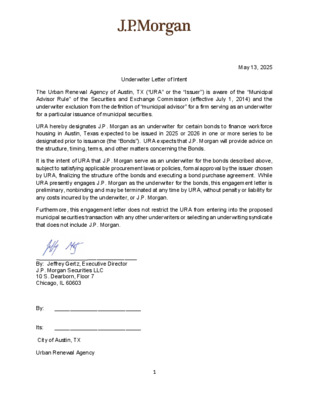

Underwriter Letter of Intent May 13, 2025 The Urban Renewal Agency of Austin, TX (“URA” or the “Issuer”) is aware of the “Municipal Advisor Rule” of the Securities and Exchange Commission (effective July 1, 2014) and the underwriter exclusion from the definition of “municipal advisor” for a firm serving as an underwriter for a particular issuance of municipal securities. URA hereby designates J.P. Morgan as an underwriter for certain bonds to finance workforce housing in Austin, Texas expected to be issued in 2025 or 2026 in one or more series to be designated prior to issuance (the “Bonds”). URA expects that J.P. Morgan will provide advice on the structure, timing, terms, and other matters concerning the Bonds. It is the intent of URA that J.P. Morgan serve as an underwriter for the bonds described above, subject to satisfying applicable procurement laws or policies, formal approval by the issuer chosen by URA, finalizing the structure of the bonds and executing a bond purchase agreement. While URA presently engages J.P. Morgan as the underwriter for the bonds, this engagement letter is preliminary, nonbinding and may be terminated at any time by URA, without penalty or liability for any costs incurred by the underwriter, or J.P. Morgan. Furthermore, this engagement letter does not restrict the URA from entering into the proposed municipal securities transaction with any other underwriters or selecting an underwriting syndicate that does not include J.P. Morgan. ________________ _ By: Jeffrey Gertz, Executive Director J.P. Morgan Securities LLC 10 S. Dearborn, Floor 7 Chicago, IL 60603 By: ____________________________ Its: ____________________________ City of Austin, TX Urban Renewal Agency 1 Disclosures Pursuant to MSRB Rule G-17 I. Disclosures Concerning the Underwriter’s Role: (i) MSRB Rule G-17 requires an underwriter to deal fairly at all times with both municipal issuers and investors. (ii) An underwriter’s primary role is to purchase the Bonds with a view to distribution in an arm’s- length commercial transaction with the Issuer. An underwriter has financial and other interests that differ from those of the Issuer. (iii) Unlike a municipal advisor, an underwriter does not have a fiduciary duty to the Issuer under the federal securities laws and is, therefore, not required by federal law to act in the best interests of the Issuer without regard to its own financial or other interests. (iv) An underwriter has a duty to purchase the Bonds from the Issuer at a fair and reasonable price, but must balance that duty with its duty to sell the Bonds to investors at prices that are fair and reasonable. (v) An underwriter will review the official statement for the Bonds in accordance with, and as part of, its respective responsibilities to investors under the federal securities laws, as applied to the facts and circumstances of this transaction. II. Disclosures Concerning the Underwriter’s Compensation The underwriter will be compensated by a fee and/or an underwriting discount that will be set forth in the bond purchase agreement to be negotiated and entered into in connection with the issuance of the Bonds. Payment or receipt of the underwriting fee or discount will be contingent on the closing of the transaction and the amount of the fee or discount may be based, in whole or in part, on a percentage of the principal amount of the Bonds. While this form of compensation is customary in the municipal securities market, it presents a conflict of interest since the underwriter may have an incentive to recommend to the Issuer a transaction that is unnecessary or to recommend that the size of the transaction be larger than is necessary. III. Additional Conflicts Disclosures: J.P. Morgan has identified the following additional potential or actual material conflicts: 2 • Conflicts of Interest/Ordinary Course Business Relationships o J.P. Morgan and its affiliates comprise a full service securities firm and a commercial bank engaged in securities trading and brokerage activities, as well as providing investment banking, asset management, financing, and financial advisory services and other commercial and investment banking products and services to a wide range of corporations and individuals. In addition, J.P. Morgan and its affiliates may currently have and may in the future have investment and commercial banking, trust and other relationships with parties that may relate to assets of, or be involved in the issuance of securities and/or instruments by, the Issuer and its affiliates. o o In the ordinary course of their respective businesses, J.P. Morgan and its affiliates have engaged, and may in the future engage, in transactions with, and perform services for, the Issuer and its affiliates for which they received or will receive customary fees and expenses. Under certain circumstances, J.P Morgan and its affiliates may have certain creditor and/or other rights against the Issuer and its affiliates in connection with such transactions and/or services. In the ordinary course of their various business activities, J.P. Morgan and its affiliates, officers, directors and employees may purchase, sell or hold a broad array of investments and may actively trade securities, derivatives, loans, commodities, currencies, credit default swaps and other financial instruments for their own account and for the accounts of customers. Such investment and trading activities may involve or relate to assets, securities and/or instruments of the Issuer (whether directly, as collateral securing other obligations or otherwise) and/or persons and entities with relationships with (or that are otherwise involved with transactions by) the Issuer. J.P. Morgan and its affiliates also may communicate independent investment recommendations, market advice or trading ideas and/or publish or express independent research views in respect of such assets, securities or instruments and at any time may hold, or recommend to clients that they should acquire, long and/or short positions in such assets, securities and instruments. 3