Item 2 - Draft Task Force Report as of 070314 — original pdf

Backup

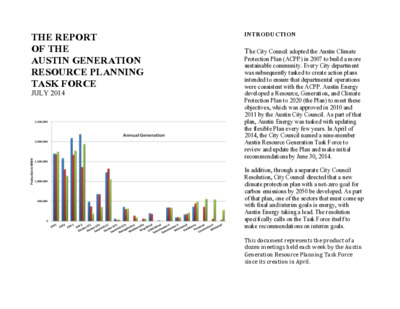

THE REPORT OF THE AUSTIN GENERATION RESOURCE PLANNING TASK FORCE JULY 2014 INTRODUCTION The City Council adopted the Austin Climate Protection Plan (ACPP) in 2007 to build a more sustainable community. Every City department was subsequently tasked to create action plans intended to ensure that departmental operations were consistent with the ACPP. Austin Energy developed a Resource, Generation, and Climate Protection Plan to 2020 (the Plan) to meet these objectives, which was approved in 2010 and 2011 by the Austin City Council. As part of that plan, Austin Energy was tasked with updating the flexible Plan every few years. In April of 2014, the City Council named a nine-member Austin Resource Generation Task Force to review and update the Plan and make initial recommendations by June 30, 2014. In addition, through a separate City Council Resolution, City Council directed that a new climate protection plan with a net-zero goal for carbon emissions by 2050 be developed. As part of that plan, one of the sectors that must come up with final and interim goals is energy, with Austin Energy taking a lead. The resolution specifically calls on the Task Force itself to make recommendations on interim goals. This document represents the product of a dozen meetings held each week by the Austin Generation Resource Planning Task Force since its creation in April. 2 AUSTIN GENERATION TASK FORCE JULY 2014 We have received numerous briefings from Austin Energy which can be found on our website. We have also provided the most relevant pages of those presentations in the appendices section. During these meetings, we have heard from planners at ERCOT, from Pecan Street Inc., and from various providers in the renewable, demand response, and storage industries. These presentations are also available on the website. At the end of May, after a day of presentations by Task Force Members, we opened the meeting up to the public where we heard from a host of speakers who spoke passionately and eloquently about the importance of the work of the Task Force. Video of this public input can also be found on the website. Unlike previous reports of this nature, the Task Force has not prescribed a mix of resources. Instead we have applied Council’s newly created net zero resolution as a primary metric to generation. We have based this report on the three pillars of Sustainability, on the things we think we know, but we don’t, the constant tension between generation and efficiency, and the methods and models we must examine in order to maintain a profitable electric utility into a energy future that is changing rapidly. The Task Force offers these recommendations that are both wide‐ranging and incremental. We believe that given the evidence we were provided, that they are achievable, affordable, and effective. We applaud the Council for its leadership and vision and we applaud Austin Energy for its accomplishment of reaching our renewable energy goals years ahead of schedule. It’s our hope that this work will contribute to a dialogue that keeps Austin a leader in clean, affordable, and equitable energy. AUSTIN GENERATION TASK FORCE JULY 2014 3 TABLE OF CONTENTS THE PILLARS OF SUSTAINABILITY ECONOMICS ENVIRONMENT EQUITY UNKNOWN KNOWNS THE PRICE OF GAS THE PRICE OF SOLAR THE PRICE OF CARBON WATER MEGAWATTS VS NEGAWATTS REPLACING DECKER BEYOND COAL EFFICIENCY AND DEMAND RESPONSE ZERO ENERGY BUILDINGS METHODS AND MODELS NODAL STORAGE THE INTEGRATED UTILITY RECOMMENDATIONS APPENDICES AUSTIN ENERGY CHARTS TASK MEMBER ADDITIONS CITIZEN INPUT TOP 4 PEAK DAYS 2013 4 AUSTIN GENERATION TASK FORCE JULY 2014 THE PILLARS OF SUSTAINABILITY ECONOMICS The term economic, with regard to the work of this task force, addresses the costs or expenses, benefits, risks and overall value of spending financial capital for the purpose of providing clean, affordable, reliable energy. Economic issues are universal to all members of a community, but how those members precisely define them may differ greatly. The task force’s challenge is to consider all of these viewpoints and make recommendations that result in a high return on economic investment, affordable rates, environmental protection and restoration and equitable availability and delivery of all benefits to all customer classes, ultimately resulting in a resilient, green local economy. This report intends to identify recommendations that are economically viable for the customer, the utility and the overall community. An economic decision is one that is based on all the costs of an alternative. Costs and benefits should always be weighed heavily in the decision making process. With respect to electricity generation, cost-benefit analysis must take into account capital, fuel, operation and maintenance, transmission and distribution, decommissioning, environmental compliance and impact to climate change, public health and social equity. With respect to purchasing electricity, it must take into account the rates, taxes, and fees paid to the utility and the ability to reduce demand through energy-efficiency programs, demand response, and the ability to generate and store power through on-site renewable generation systems. The two broad considerations of cost are providing affordable electricity for all customers and maintaining a financially healthy utility. AUSTIN GENERATION TASK FORCE JULY 2014 5 ENVIRONMENT Environmental impacts from electric generation are of importance to the long-term health and stability of the planet at large, and to the immediate health, wellbeing and prosperity of residents in Austin and surrounding areas in the short-term. The health and lifestyle benefits that come with access to reliable electricity can be offset by costly health problems and extreme weather if electric generation is not done responsibly. Health Impacts of Air Pollution Both coal- and gas-fired power plants contribute to air pollution that is harmful to human health. In 2013, Austin Energy’s portion of the coal-fired Fayette Power Project emitted over 2,000 tons of nitrogen oxides and over 400 tons of sulfur dioxide into the air. Nitrogen oxides, which contribute to the creation of ozone, and sulfur dioxide cause and worsen respiratory diseases. The annual cost of health problems and the resulting emergency room visits, hospital admissions and even deaths from the pollution from the Fayette coal plant are about $55.5 million (Clean Air Task Force). The health impacts include: •Asthma Attacks •Chronic Bronchitis •Heart Attacks While it doesn’t emit as large a quantity of these pollutants, the Decker gas-fired power plant is located within Austin city limits and therefore directly impacts a large number of people. Additionally, the economic considerations of a generation resource decision must take into account community goals for affordability, environmental protection, water conservation, job creation, economic development, customer protection and equity. Procurement decisions must be set within the context of resulting in a return of benefits that exceeds the costs of a capital investment. Benefits should be heavily weighed against costs. Both costs and benefits should align with community goals and should be equitably distributed to all members of a community. The benefits of clean, affordable, reliable energy include lower customer bills that result in economic capital available for other investments, reduced air pollution and healthier ecosystems, increased job creation, reduced demand on infrastructure and improved overall public health. Affordability in Austin More than half of Austin Energy’s residential customers are defined as low-income or low-moderate income households. As the Austin population grows and the housing market booms, property taxes, rent, the cost of living and the cost of doing business, continue to rise, affordability is an extremely important and timely issue. RECOMMENDATION Austin Energy should continue to adhere to the affordability goal as passed by the Austin City Council in February of 2011. 6 AUSTIN GENERATION TASK FORCE JULY 2014 Climate Change Costs Our Communities Global climate change has accelerated and the impacts are being felt across Texas, including in Austin. The Texas drought of 2011 caused agricultural losses of $7.62 billion, making it the most costly drought in history, according to Texas A&M AgriLife economists. That drought also led to devastating wildfires, taking lives and property. 31,453 fires burned over 4 million acres across Texas. Total damage due to loss of property, timber and agriculture exceeded $750 million. The Onion Creek flood in 2013 destroyed over 600 homes and caused over $30 million in insured losses. This tragedy resulted from intense rainfall on already saturated soils. Many homeowners in that low-lying area have been or are being bought out with tens of millions of dollars of city, county and federal money. While no single weather event can be definitively attributed to climate change, the vast preponderance of evidence shows that higher global temperatures increase the likelihood of prolonged drought, more severe storms and intense rainfall events. Although Austin Energy cannot combat global climate change on its own, it can do its part to not contribute further to the problem and can serve as a model for other utilities to take similar action. In 2013, Austin Energy was directly responsible for over 4.8 million metric tons of carbon Dioxide emissions, which cause climate change. Methane emissions from the extraction, processing and transportation of the natural gas burned in Austin Energy’s plants is not included in that figure, but makes a significant contribution to climate change because methane is a much more powerful greenhouse gas than carbon dioxide. Over a 20-year period, the total climate change impact of using natural gas is almost as significant as that of using coal. Because it is beyond Austin Energy’s ability to control these emissions and comprehensive and effective regulation to stop methane emissions is unlikely in the near-term, especially in Texas, the utility should wean itself from natural gas as quickly as possible. Austin City Council passed a resolution establishing a goal of achieving net zero greenhouse gas emissions city-wide by 2050, or sooner, if possible. In that resolution, Council recognized that some sectors might have more difficulty meeting that goal than others. Austin’s electric sector is uniquely poised to eliminate all greenhouse gas emissions on an earlier timeline because its sources of greenhouse gas pollution are centralized and controlled by Austin Energy. In contrast, thousands of individuals with internal combustion engine vehicles contribute to the city’s transportation-related greenhouse gas emissions. Drought-Proof Energy Sources Climate change projections indicate that the western and central parts of Texas, including Austin, are likely to become even drier in the decades to come. AUSTIN GENERATION TASK FORCE JULY 2014 7 Water shortages being experienced now may be the new norm. With water becoming ever more rare and precious, every effort should be taken to ensure that it is used sparingly. Electric production from coal, nuclear and natural gas plants require significant quantities of water. Austin Energy’s portion of the Fayette coal plant needs 1.3 billion gallons of water to operate annually and its portion of the South Texas Nuclear Project needs 1.85 billion gallons. While the utility’s natural gas plants use less water in their operations, hydraulic fracturing to extract the natural gas uses water that is then injected into disposal wells and removed from the hydrological cycle. In contrast, wind turbines require no water to operate and solar farms use only a very small amount for occasional cleaning of the solar panels. Relying on large quantities of water for electricity production poses a reliability risk as well. If water is not available or becomes too warm to provide cooling, power plants are forced to shut down. This occurred in other parts of Texas during 2010 and 2011. Accelerating the Transition Austin Energy has made great strides in expanding its use of renewable energy resources and now is the time to build on that success by establishing a 2030 zero greenhouse gas emission goal, with interim goals to ensure progress. Robust energy efficiency, demand response, and renewable energy goals will keep Austin Energy focused on making investments to achieve this goal affordably. RECOMMENDATION Austin Energy should abide by Council Resolution and reduce CO2 emissions to zero as early as 2030 providing affordability metrics are maintained. 8 AUSTIN GENERATION TASK FORCE JULY 2014 EQUITY Equity is to utility policy as economic justice is to broader social policy. It is a concept in which economic policies must result in distribution of benefits equally to all. A difference is that in a utility system all customers pay into the system through the rate structure. Services, program and policies need to be structured to assure equal access to service and an equitable distribution of benefits to all customers and to prevent subsidies to wealthier customers being paid for by lower-income consumers. Equity places a greater emphasis on economic justice and fairness than on economic efficiency. Well over half – 64% – of Austin Energy’s residential customers are very poor or working poor living from paycheck to paycheck. There is little evidence that Austin Energy’s energy efficiency and solar programs will provide benefits for these customers unlikely to invest in energy efficiency due to lack of income. •38% (131,501) low-income households served by Austin Energy have income below 200% of the Federal Poverty Guideline (FPG) •26% (87,576) low-moderate income households served by Austin Energy have income between 200 and 400% of the FPG or $47,700 to $95,400 for a family of four. •The Economic Policy Institute estimates a subsistence income level for a family of four in the Austin Round Rock Area at $66,670. A national study concludes that low-income customers tend to live in smaller older homes that use 28% more energy per square foot than homes occupied by average and upper income households. The Pecan Street Project reports that older homes that have energy retrofits use 29% less electricity for cooling than homes with no retrofit. While lowering bills and making utilities more affordable for low-income families, weatherization programs: •reduce the utility’s peak demand avoiding the cost of new power plants •save kilowatt-hours reducing fuel use and emissions •create local jobs and further stimulate the local economy through the multiplier effect •reduce utility and debt and collection costs •enhance property value, extend lifetime of dwelling, and lower the number of fires •provide residents with a healthier home thereby reducing societal and economic costs caused by illness Because all AE customers pay for energy efficiency all AE residential customers should have access to a weatherization program. AE has only a small low-income weatherization program with very low performance and no low-moderate income weatherization program. Prior to 2020 Austin Energy should accomplish the following: AUSTIN GENERATION TASK FORCE JULY 2014 9 •Provide low- and low-moderate income weatherization to meet 10% of its energy efficiency demand reduction goal through these programs. •Provide new renewable generation resources to underserved customers. •Provide quarterly reports on its EE programs and progress in meeting goals for underserved programs. •Insure low- and low-moderate income weatherization budgets are efficiently spent with minimal administrative expense. •Survey all customers participating in an EE program to measure the level of customer satisfaction and demographic data such as income, race, and education level. Austin Energy and the City need to take deliberate steps to reach its goal for net zero energy growth and achieve many energy efficiency savings that will lower the bills of households paying an above average percentage of their income for electricity. The following are concepts the city should thoroughly explore. •Determine the amount of incentive payments on an income sensitive sliding scale. The sliding scale of incentives can be applied to every Austin Energy residential program by offering 100% of cost as an incentives to those below 200% of the Federal Poverty Guideline and reducing the percent of the incentive as income increases . •Neighborhood based energy efficiency programs. Conduct energy efficiency programs that are geographically targeted to underserved neighborhoods in the city. Preferably this should be a joint effort with Neighborhood Housing to maximize the number of homes retrofitted. It is not uncommon for homes to be disqualified for energy efficiency improvements because of a significant need for ancillary repairs. Having a remedy for the needed home repairs will help the families the most and maximize the energy saving benefits of the program. •Combine community and city resources to effectively deliver programs (e.g. single point of contact), locate the underserved (e.g. door-to-door outreach) and deliver energy efficiency and renewable energy program benefits to them. •Create a consumer committee to make recommendations to Austin Energy and City Council regarding development and design of energy efficiency and renewable energy programs for underserved residential consumers. RECOMMENDATION Council should set a new Energy Efficiency Goal for Saving Energy in the Underserved Customer Population 10 AUSTIN GENERATION TASK FORCE JULY 2014 UNKNOWN KNOWNS THE PRICE OF GAS In the big picture, The Generation Task Force of 2014 is faced with a relatively simple analysis. As a community, the choices to meet our growth and the environmental goals we have set for ourselves, as well as future EPA regulations, range between using more natural gas, buying more solar and wind, implementing more demand response and energy efficiency, and using more market purchases. There has been no real consideration given to building more coal plants or expanding our nuclear facilities. Therefore in determining our energy future, the biggest unknown known is the actual cost of natural gas over the next 30 years. There are many who view that future quite brightly. According to the Oil & Gas Industry and their proponents, “fracking” will provide the US with energy security, low energy prices for the foreseeable future, more than a million jobs, and economic growth. “There’s no doubt that we’re seeing an industrial revolution… taking place because of the shale revolution.”–Ed Morse, Global Head of Commodities Research at Citigroup AUSTIN GENERATION TASK FORCE JULY 2014 11 “[the biggest thing economically to hit Ohio, since maybe the plow.”–Former Chesapeake CEO Aubrey McClendon “[The surge of U.S. oil and gas production] is the biggest change in the energy world since World War II.”–Fatih Birol, Chief Economist at the IEA However as Bloomberg reports: “Among drilling critics and the press, contentious talk of a "shale bubble" and the threat of a sudden collapse of America's oil and gas boom have been percolating for some time. While the most dire of these warnings are probably overstated, a host of geological and economic realities increasingly suggest that the party might not last as long as most Americans think. “The problems arise when you look at how quickly production from these new, unconventional wells dries up. David Hughes -- a 32-year veteran with the Geological Survey of Canada and a now research fellow with the Post Carbon Institute, a sustainability think-tank in California -- notes that the average decline of the world's conventional oil fields is about 5 percent per year. By comparison, the average decline of oil wells in North Dakota's booming Bakken shale oil field is 44 percent per year. Individual wells can see production declines of 70 percent or more in the first year. “Currently, natural gas is moving at about $4.50 per MMBtu -- a welcome uptick, but by no means production, let alone keep it growing.” 12 AUSTIN GENERATION TASK FORCE JULY 2014 This decline in growth can already be seen in four of the early shale plays. In Texas, even as the Eagle Ford shale play continues to grow, the Barnett shale is in decline according to the Bureau of Economic Geology. In Austin Energy’s presentations to the Task Force, they have relied on gas forecasts from Wood Mackenzie. The base case in this forecast shows that natural gas prices will reach $5.00/ mcf in 2019. Henry Hub prices went to $8.00 last January before retreating to the 4.50 to $5.00 range since. Using optimistic low gas prices makes new gas plants look profitable and it skews the value of both utility and distributed solar downward. Austin Energy presented to the Task Force that generation costs for all of our gas generation units is in the 80.00/ MWh range. Generation from all gas units in 2012 was 2.6 TWhs. At heat rates of 10,000 BTUs/kWh, which Decker does not achieve, each dollar increase in natural gas prices increases generation costs by 10.00 dollars/ MWh. Any runs or cost comparisons by Austin Energy that includes even the medium case scenarios provided to the Task Force may be susceptible to significant error due to forward gas price forecasts inaccuracies. Council should not approve any future gas plant or value of solar tariff without seeking broad expert advice and counsel on the long-term gas price outlook. RECOMMENDATION AUSTIN GENERATION TASK FORCE JULY 2014 13 THE PRICE OF SOLAR For many years, advocates of clean solar energy talked about the day when solar energy would be less than a nickel a kWh. That day arrived with Austin Energy’s most recent RFP for solar which resulted in a 150 MW purchase at prices below 5 cents/kWh. These prices for solar are the results of many years of research and development and 14 AUSTIN GENERATION TASK FORCE JULY 2014 commodity cost reductions. In the last five years, silicon costs alone have dropped from $270.00/ Kilogram to less than $15.00/ Kg. Balance of system costs such as inverters have been reduced five fold. As the Industry matures, the cost of capital has dropped. And not only have prices dropped, but also the Solar Industry has matured. Companies like First Solar now provide prediction services that are 88% accurate, and with advanced power electronics, solar power plants can provide stability services to the grid. The “unknown known” is whether or not prices will go even lower in the future, even as tax benefits do or do not expire at the end of 2016. Unlike the gas market, the solar market is fixed and prices can be locked in. The issue is the opportunity costs of even lower prices and whether or not a unique buying opportunity exists over the next six months. Using Austin Energy’s low case, levelized costs for new generation using West Texas PV is $45.00/MWh. The low case for an advanced natural gas combined cycle technology is $69.99. Currently, gas generation averages around 80.00/MWh. Levelized cost for advanced combustion turbine generation is $167.00/MWh. Based on Austin Energy’s experience with our first utility plant in Webberville, solar capacity factors on summer peak days are approaching 70%. For solar plants in far West Texas, that factor will be higher due to higher insolation values and longitudinal time differences. At prices under 5 cents/Kwh, solar energy generation is now less than the marginal cost of gas generation at gas prices of $5.00/mcf and heat rates of 10,000 Btu’s/ kWh. It is a fixed hedge against rising gas prices and future carbon costs. Local solar investments can also aid in local economic development. A 2012 study by solar Austin found that the solar industry employed over 615 people in the Austin area with an annual payroll of over $20 million making it the 40th largest industry in the city RECOMMENDATION Solar Energy generation should become the default new generation resource through 2024. Furthermore, Austin Energy should consider acquiring additional solar if a unique buying opportunity for solar exists between now and 2016. AUSTIN GENERATION TASK FORCE JULY 2014 15 THE PRICE OF CARBON On June 2, “President Obama outlined a proposal to dramatically slash carbon dioxide emissions from the nation’s existing power plants in the coming decades. The plan, to be overseen by the U.S. Environmental Protection Agency, represents the Obama administration's most ambitious effort to address climate change. Texas will have to make more drastic reductions in carbon emissions from its power plants than many other states, according to the current proposal. Texas power plants emit about 1261 lbs. per MWh according to EPA and the newly proposed carbon rules would require CO2 emissions from old coal plants to be reduced to 791 lbs. per MWh. How and when these rules will take effect is important to Austin and Austin Energy. “The EPA says the power industry could spend up to $8.8 billion annually by 2030 to comply with the rules, and that doesn’t include monitoring, reporting or record-keeping. But, it adds, that’s less than 5 percent of the total projected annual spending by the industry in 2030. The EPA also estimates that electricity prices would rise between 3 and 6 percent by 2020 under the proposed rules, but Americans’ electricity bills would actually decrease by 2025 because of energy efficiency measures.” RECOMMENDATION Austin is an early adopter of climate protection and we must insure that state rules are written that do not punish good behavior. 16 AUSTIN GENERATION TASK FORCE JULY 2014 WATER While the Generation Task Force was conducting its work, another Task Force on water has also been meeting. The results from the Water Task Force have just been published. The Generation Task Force did hear from the vice chair of the Water Task Force. In addition, the Task force heard from a UT climate change professor who spoke about water resources in the Colorado Basin over the next 50 years.. And the results do not look encouraging. The Colorado River basin that provides Austin’s water used to provide a million acre-feet of water a year. Now, that average may be half of that. In the last two years it has been a quarter of that historical average. In 2011, the lowest inflow year on record, it was 10% of the average. Five of the nine lowest inflow years ever have occurred in the last six years. 2014 inflows from January through May are the sixth lowest on record for that five-month period. Lakes Travis and Buchanan, the region's water supply reservoirs, gained more than 76,000 acre-feet in combined storage in May, more than in the first four months of 2014 combined, but the inflows were still only 38 percent of average for May. Currently, Lakes Travis and Buchanan stand at 40 percent of capacity as the region heads into what is forecast to be a dry summer. Combined storage in lakes Travis and Buchanan could drop below 600,000 acre-feet, or 30 percent of capacity, later this year. If that occurs, the Lower Colorado River Authority Board of Directors would issue a Drought Worse than the Drought of Record declaration. Following a state-approved plan, LCRA would then require cities, industries and other firm customers to reduce their water use by 20 percent, and would cut off all Highland Lakes water to interruptible customers. At this writing, Energy’s chart of water use per plant is still under construction in their performance review of 2013, but in general, thermal power plants use 400 to 800 gallons of water/MWh. At 10 TWhs of thermal generation, total water use would be 400 to 800 million gallons annually or approximately 2,000 acre/feet. Austin Energy has rights well beyond this amount. RECOMMENDATION Austin Energy should strive to reduce water use and aid in water management. AUSTIN GENERATION TASK FORCE JULY 2014 17 MEGAWATTS VS NEGAWATTS REPLACING DECKER Decker Creek Power Plant is a 927 MW natural gas facility located in northeast Austin. It was commissioned in 1970 with additions as recent as 1988. It is the oldest power plant in the Austin Energy fleet. Austin Energy is considering retiring the plant in 2017. It has two steam turbines rated at 315 MW and 420 MW. There are also four 48 MW gas turbines. Since 2011, use of Decker’s steam turbines has decreased from 1.2 TWhs to .53 TWhs in 2013. Use of the combustion turbines has declined to 34,000 MWs or slightly more than half of the production from the Webberville solar plant. Decker’s steam turbine cost range from $80.00 to $95.00/MWh, and Decker’s combustion turbines range from $150.00 to $200.00/MWh. Consequently, costs at Decker on the steam units are about the same as the biomass plant, and the costs on the combustion turbines are roughly equivalent to the Webberville solar plant. ($165/MWh). In 2013 the biomass plant only ran 9% of the time, generating about 80,000 MWhs. In the most recent year, the Decker steam units ran mostly from June through September 18 AUSTIN GENERATION TASK FORCE JULY 2014 averaging from 80,000 to 120,000 MWhs per month. The combustion turbines follow the same summer use pattern. In old utility parlance, the Decker steam units would be considered “intermediate” units and the combustion turbines would be considered “peakers.” To replace last years summer use with solar would require about 600 MWs of West Texas solar. Such a plant or portfolio of plants would produce more than 1.2 GWhs annually and would therefore provide the same amount of energy that Decker provided in 2012. At prices below $50.00/MWh, replacing the plant could save $40.00/MWh or $20,000,000. A retired Decker would also free up the 1200-acre Walter E Long Lake for potential water management. A repurposed plant site could support several hundred megawatts of solar. RECOMMENDATION Replace the Decker Creek Power Plant with 600 MWs of West Texas solar PV before 2016. AUSTIN GENERATION TASK FORCE JULY 2014 19 BEYOND COAL Coal plants are being retired across the country because of a combination of factors such as lower priced natural gas, environmental impact, inefficiencies, water constraints and because it is difficult for them to respond to changes in electric demand. As of the summer of 2014, 167 coal plants across the nation have announced their plans to retire and America is moving beyond coal towards to a cleaner energy future. “We are clearly witnessing the end of our dependency on coal and the move toward a cleaner energy future," said Mike Bloomberg, whose Bloomberg Philanthropies has contributed $50 million to the Beyond Coal Campaign. “Coal-fired power plants and the pollution they produce—including mercury—are the number one threat to our public health and the environment. This is an issue of the American people's public health versus a narrow special interest. And we will not stop until we have achieved our goal.” According to the Clean Air Task Force, the removal of 112 coal-fired power plants translates into the prevention of around 2,166 deaths, 3,426 heart attacks, and 35,210 asthma attacks every year. This campaign has certainly had its effect in Austin. For three years, activists have worked on closing the Fayette coal plant. 20 AUSTIN GENERATION TASK FORCE JULY 2014 The facility is located on a 10-square-mile site seven miles east of La Grange. It comprises three units capable of generating up to 1,625 megawatts (MW) of electricity. That’s enough to serve about 406,000 typical Central Texas homes. Austin Energy owns 50 percent of units 1 and 2, which comprise the Sam K. Seymour Generating Station. In 2013, units 1 and 2 generated 1.75 TWhs and 1.9 TWhs. In 2012 the two units generated 1.65 and 1.35 TWhs. In 2011, they produced 2.08 and 2.17 TWhs. In our current generation plan, the plan envisions that the use of coal would be ramped down as renewables are ramped up. Instead, the use of gas has ramped down as gas fuel costs dropped from $250,000,000 in 2008 to $148,000,000 in 2012. During that same period, renewable energy purchases grew from $26,000,000 to $97,000,000. In the economic dispatch model that is the basis of the Texas Nodal Market, the cheapest units are dispatched not necessarily the cleanest. If carbon is priced at $20/T, then at the rate of 2,000 lbs./MWh, each MWh of coal generation will increase by $20. Currently, Fayette generation runs between $42.00 and $44.00/MWh. With the addition of this carbon adder, generation costs will move above $60.00/MWh, and both wind and solar will become economic as more of the externalized costs of coal generation are priced into the market. When this happens, Fayette can be ramped down without serious rate increase consequences. And if Austin owned one unit completely instead of half of both units, this ramp down could be affected. However, the partnership agreement between LCRA and Austin makes this action by Austin very difficult due to the terms in the agreement that disallow either party to sell or divide the property. This clause in the partnership agreement might be a “restraint on alienation”. Such an attempt in a deed or will to prevent the sale or other transfer of real property either forever or for an extremely long period of time is generally unlawful. RECOMMENDATION To begin the retirement process independent of LCRA, Austin should seek 100% ownership of one of the Fayette units. AUSTIN GENERATION TASK FORCE JULY 2014 21 ENERGY EFFICIENCY AND DEMAND RESPONSE Between 1982 and 2006 energy efficiency programs administered by Austin Energy offset the need to build a 700 MW power plant. In 2007, Austin Energy kicked off a new goal with the Austin climate protection plan to offset another 800 MW of peak energy demand by 2020. Austin Energy has achieved 371 MW of the 800 MW goal. Currently Austin Energy offers a menu of programs for residential and nonresidential customers. Their energy efficiency and demand response programs are beneficial to the utility, the customer, the environment and the economy. The overall benefit cost ratio to Austin Energy is 2.3 avoiding the need to build new capacity and buy fuel. For customers who participate in the programs the overall return is 4.3 providing the benefit of lower electricity bills. Every year energy efficiency programs avoid an estimated 63,000 metric tons of carbon dioxide emissions and create jobs in our community. The American Council for an Energy Efficient Economy estimates that a $1 million investment in energy efficiency created 20 jobs compared to 17 in a business as usual scenario. New more energy efficient products and equipment are continually being developed that use less electricity to operate than older models. The old fashioned incandescent light bulb gave way to the compact fluorescent which is now giving way to light emitting diode (LED). Under an agreement reached in January 2010 at the U.S. Department of Energy by the air conditioning industry and other groups the minimum standard for split system air conditioners in the South will increase to SEER 14 effective January 1, 2015. The development and adoption of smart meters technology is providing the capacity to give customers more information about the way they use electricity and greater ability to control that usage during peak demand hours. There is an assumption in Austin Energy’s current energy efficiency and demand response program planning that the cost effective energy efficiency options are mostly used up and that increasing the goals for energy efficiency would be too costly. Another viewpoint expressed by members of the community is that there is plenty of cost effective energy efficiency potential in Austin and that the programs need to be revamped in order to tap into that potential. Specifically the air conditioner rebate and other programs need to be restructured to promote the highest equipment efficiency levels and the Energy Conservation Audit Disclosure Ordinance should be fully enforced and amended if needed. Energy efficiency is a customer’s best insurance policy against rising energy costs and should be a first priority for the utility and is a first step in reaching the city’s net-zero energy goal. The existing 800 MW goal of energy efficiency should be increased to 1200 MWs by 2024 with 200 MW of the goal being met by demand response. RECOMMENDATION 22 AUSTIN GENERATION TASK FORCE JULY 2014 ZERO ENERGY BUILDINGS As the cost of solar cells and panels continue to plummet to wholesale prices around 50 cents/watt, prices for installed systems on homes and businesses follow. Consequently, Austin energy rebates for residential systems have also been reduced. During the time of these Task Force Meetings, the residential rate was reduced to 1.25/ KW and the commercial rate was reduced to 9 cents/Kwh. At present, there are about 3500 buildings in Austin with solar installed on their rooftops. Although many of these structures use solar to reduce their bills, almost 400 or 15% of them actually produce more electricity than they use. These zero energy (electric) buildings are not necessarily modern state of the art structures. Many, in fact, are relatively straightforward suburban homes with good insulation, good windows, smart thermostats, and smart owners. One member of the Task Force owns a 2,000 square foot home that used 7,000 Kwhs last year with 2500 Kwhs going to power the plug in Volt. The solar system on the roof produced 6672 Kwhs, providing 145% of the home use and 95% of the home and car use. Another citizen who follows the meetings of the Task Force has very similar numbers with his house and electric Leaf vehicle. These early adopters demonstrate that zero energy buildings are not just the future, they have now become the present. A 2009 report for Austin Energy found that the potential solar generation from existing rooftops in Austin was 2,324 MW and that these systems could produce about 27.6% of our annual energy needs. Currently, there are at least five builders offering net zero energy homes in the city. These net zero energy buildings are created through a combination of sustainable and efficient design strategies and technologies that reduce demand and on-site renewable energy to produces the remaining energy required. Austin has a policy that requires all new homes to be net zero energy capable by 2015, but an update to that policy will allow Austin Energy to more fully harvest the full benefits of the advances in green building. RECOMMENDATIONS Council should adopt a zero energy building ordinance that accelerates distributed solar through third party leasing. City Council should adopt a policy that builders of all new single family homes built after 2019 should offer buyers an optional solar package, either on the rooftop or as part of a community solar project A task force should be formed to research and provide recommendations on achieving net zero energy for all new commercial spaces. AUSTIN GENERATION TASK FORCE JULY 2014 23 METHODS AND MODELS NODAL PRICING On December 1st, 2010, the electric Reliability Council of Texas began operation of its nodal wholesale market with over 4,000 nodes or points of potential energy price differentiation. For the first time in our Texas electric grid, the ERCOT nodal system introduces a centralized, day ahead energy auction market that exists in addition to the bilateral market that is available to qualified scheduling entities. (QSE) This means that all generators sell into this market at the local node price and then buy energy back at the node of purchase. This local marginal price (LMP) may or may not be the same price. It might be higher or it might be lower. Over the last few years because of higher use and congestion in the oil play areas in west Texas, LMP prices have been significantly higher than at the Austin load zone. Consequently the QSE might make more money than it paid for the energy. Likewise, in the evenings when energy is less in demand, wind facilities in the west push the LMP very low, some times into prices below zero. In these cases, the QSE might lose money on the delta between the LMP price and the contract price. Sometimes a transmission line goes down and local congestion moves LMP prices. On occasion, a power plant drops off line and LMP prices suddenly move up so that other power plants in the area can respond by bringing up more generation. But in the vast majority of time, LMP at the place of energy insertion is the same price as the place of delivery. The Austin Energy QSE sells into ERCOT and then it buys it right back at the same price. This happens with approximately 85% of the energy we use. The other 15 % is a market purchase. That means that out of the 13 TWhs that AE sells to its customers about 2 TWhs are market purchases. Because AE is a generator and a retail provider, LMP pricing is not part of the cost equation for us 85% of the time. In this equation, the LMP sell/buy event cancels itself out leaving our actual energy costs as the real costs that our customers must pay. Curiously, when Austin Energy values wind or solar projects simply based on the projected LMP at the insertion point rather than the delta between the two points and the decremental value of buying from the market instead of running our gas plants, results do not accurately reflect the situation they are trying to model. Moreover, in modeling the value of new generation, new generation should be compared with cost of other new generation, not the value in the nodal market. 24 AUSTIN GENERATION TASK FORCE JULY 2014 not the value in the nodal market. If Austin energy places a new gas plant on the gen plan, then comparisons should be made against the costs of that projected generation. Using AE’s own data, this methodology shows that our gas plants lost $14,000,000 in 2012 and $81,000,000 when you include gas hedging. This methodology further shows that our recent 150 MW, $48.00 solar purchase would have only lost $7,000,000 in 2012. Given that our average cost of production for the entire system was 51.00/MWh in 2012, this methodology ultimately runs into a proverbial brick wall. Consequently, the Task Force will not ask AE to run any generation scenarios even though certain individuals or groups may. RECOMMENDATION Austin Energy should return to a planning methodology that compares generation alternatives to actual generation costs not nodal market income alone. AUSTIN GENERATION TASK FORCE JULY 2014 25 STORAGE While doing its work, the Task Force heard from several storage vendors and proponents. The presentations range from CAE projects to battery technologies. One involved the splitting of water into hydrogen and water. Another presented how electrical energy can be converted into chilled water and then used to reduce demand in the afternoon as buildings use that chilled water instead of electricity for cooling. That is precisely what Austin Energy does with its downtown chilled water loop. Except for the CAES presentation, very few presenters had actual prices to quote. However in Austin Energy’s technology cost chart CAES is prices in the $74.00 to $97.00/MWh range. It is generally believed that as penetrations of renewable energy increase, storage must be provided to stabilize the grid. And in large percentages this is true. But in the ERCOT market, ERCOT is responsible for grid stability. And there are many other techniques for providing energy into the grid besides using stored energy. You can start a gas turbine. You can bring up a combined cycle unit. You can use the emerging smart grid to control demand. Another approach is to use the transportation sector and the building sector. The former top electric regulator in this country and a leading proponent of smart grid applications that provide demand response agrees. “FERC chairman: Let EV owners sell juice to grid. “ source CNET “The top regulator of the wholesale electricity markets said that electric-vehicle drivers should be able to make money selling services to grid operators. Federal Energy Regulatory Commission (FERC) Chairman Jon Wellinghoff today said electric-car owners could make as much as $3,000 a year providing what are called ancillary services, such as frequency regulation, to stabilize the wholesale electric market. Those types of services are technically possible today but regulations need to be changed and new businesses need to be formed before EV owners are active sellers into the grid, Wellinghoff said. But he predicted that within three to five years, vehicle-to-grid services will be available throughout the U.S. “ Mr. Wellinghoff’s vision is the vision that Austin Energy has promoted and explored through its Plug-in campaign efforts. One presenter to Task Force represented that using the transportation sector could possibly provide significant storage. 26 AUSTIN GENERATION TASK FORCE JULY 2014 To this end, Elon Musk of Tesla is building his lithium ion battery gigafactory for this very purpose. There are others who are working on solid-state storage that could revolutionize the energy markets with storage technologies that are as important as the flash drive was to computing. However, given that the numbers for CAES storage are actually below the numbers for combustion turbines in the Austin Energy analysis, we believe that Austin Energy should consider 200 MWhs of storage to aid in extending both our wind and solar portfolios. THE INTEGRATED UTILITY Austin Energy is one of the premier electric utilities in the country. It is known for its leadership in energy efficiency, renewables, and green building. By reaching the 35% renewable energy goal by 2016, and by being on track to reach our 1600 MW efficiency goal on schedule by 2020, it is a leader in clean, affordable, and reliable energy. But these are demanding, challenging times for the Electric Utility Industry and for Austin Energy. Just last month in Barron’s, they reported that “Barclays has downgraded the entire electric sector of the US high-grade bond market, largely over evidence that solar and other disruptive energy technologies are proving to be increasingly viable competition. They are not the first people to say this. The former Duke Energy CEO says he'd want to work in solar if he was starting out today. Some utilities are making decisive moves away from fossil fuels, and financial giants ranging from Norway's sovereign wealth fund to the Bank of England are hearing murmurings about a potential "carbon bubble". As Barclay's credit strategy team emphasizes, this is less about solar alone, and more about a confluence of technologies—most notably solar and battery storage combined—which have the potential to fundamentally reshape how energy is produced, distributed and used (or not used): RECOMMENDATION Austin Energy should consider adding 200 MWhs of storage to our generation portfolio. AUSTIN GENERATION TASK FORCE JULY 2014 27 “In the 100+ year history of the electric utility industry, there has never before been a truly cost-competitive substitute available for grid power. We believe that solar + storage could reconfigure the organization and regulation of the electric power business over the coming decade. We see near-term risks to credit from regulators and utilities falling behind the solar + storage adoption curve and long-term risks from a comprehensive re-imagining of the role utilities play in providing electric power.” In a world where some of the utilities' most profitable corporate customers—from Apple to Ikea to Mars—are investing massively in their own electricity generation capacity (and imposing carbon prices on themselves); where smart home technology promises to cut bills, even for those folks who can't be bothered in programming their thermostat; where LEDs are becoming so cheap they are a no-brainer, even for the anti-environmental crowd; where solar prices keep dropping dramatically and battery-storage innovation is just ramping up, there's good reason for investors to consider alternative options to traditionally "safe" investment in utilities.” The marker for a safe investment or bond rating is moving away from the former conventional wisdom. Just as denial of climate science does not change the physics of climate change, denial of the coming reality where demand response and zero energy structures begin to weather away growth, will not change the reality of coming reduced profits. Austin Energy must face these challenges and see the opportunities that reside within them. As the transportation sector becomes more and more fueled by the product that AE sells, there will be opportunities that fall outside of the traditional utility model. As distributed solar penetration moves from 3,000 structures to 100,000 structures, and panels become roof toppings, building siding, and fenestration, there will be opportunities for the utility to provide service and/or capital. Some of these new opportunities will require regulatory or statutory fixes or third party workarounds. Austin and its citizens deserve a community utility that can meet the challenges of the future with intelligence and creativity. The Austin Generation Resource Planning Task Force offers this report to the City Council and the Citizens of Austin in that spirit. As Paul Valery, the French poet and philosopher said in his 1937 essay “Notre Destin et Les Lettres”, “The future is not what it used to be.” RECOMMENDATION Austin Energy should transform itself into an integrated utility that employs an expanded business model that goes beyond the traditional utility model of selling Kwhs. 28 AUSTIN GENERATION TASK FORCE JULY 2014 RECOMMENDATIONS Austin Energy should continue to adhere to the affordability goal as passed by the Austin City Council in February of 2011. Austin Energy should abide by Council Resolution and incrementally reduce CO2 emissions to zero no later than 2050. Council should set a new Energy Efficiency Goal for Saving Energy in the Underserved Customer Population Council should not approve any future gas plant or value of solar tariff without seeking broad expert advice and counsel on the long-term gas price outlook. Solar Energy generation should become the default new generation resource through 2024. Furthermore, Austin Energy should consider acquiring additional solar if a unique buying opportunity for solar exists between now and 2016. Austin is an early adopter of climate protection and we must insure that state rules are written that do not punish good behavior. Austin Energy should strive to reduce water use and aid in water management Replace the Decker Creek Power Plant with 600 MWs of West Texas solar PV before 2016. To begin the retirement process independent of LCRA, Austin should seek 100% ownership of one of the Fayette units. The existing 800 MW goal of energy efficiency should be increased to 1200 MWs by 2024 with 200 MW of the goal being met by demand response. Council should adopt a zero energy building ordinance that accelerates distributed solar through third party leasing. City Council should adopt a policy that builders of all new single family homes built after 2019 should offer buyers an optional solar package, either on the rooftop or as part of a community solar project A task force should be formed to research and provide recommendations on achieving net zero energy for all new commercial spaces. Austin Energy should return to a planning methodology that compares generation alternatives to actual generation costs not just nodal market income streams. AUSTIN GENERATION TASK FORCE JULY 2014 29 RECOMMENDATIONS Austin Energy should consider adding 200 MWhs of storage to our generation portfolio. Austin Energy should transform itself into an integrated utility that employs an expanded business model that goes beyond the traditional utility model of selling Kwhs. APPENDICES AUSTIN ENERGY CHARTS TASK FORCE ADDITIONS CITIZEN INPUT