20181109-3B: Recommendation on ADTF Final Report — original pdf

Recommendation

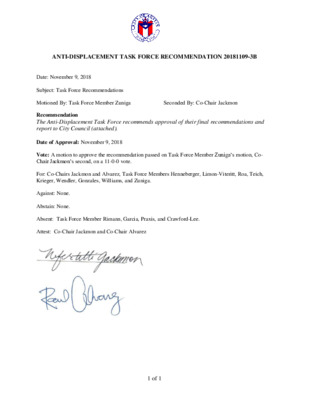

1 of 1 ANTI-DISPLACEMENT TASK FORCE RECOMMENDATION 20181109-3B Date: November 9, 2018 Subject: Task Force Recommendations Motioned By: Task Force Member Zuniga Seconded By: Co-Chair Jackmon Recommendation The Anti-Displacement Task Force recommends approval of their final recommendations and report to City Council (attached). Date of Approval: November 9, 2018 Vote: A motion to approve the recommendation passed on Task Force Member Zuniga’s motion, Co-Chair Jackmon’s second, on a 11-0-0 vote. For: Co-Chairs Jackmon and Alvarez, Task Force Members Henneberger, Limon-Viteritt, Roa, Teich, Krieger, Wendler, Gonzales, Williams, and Zuniga. Against: None. Abstain: None. Absent: Task Force Member Rimann, Garcia, Praxis, and Crawford-Lee. Attest: Co-Chair Jackmon and Co-Chair Alvarez RECOMMENDATIONS FOR ACTIONNovember 2018 CITY OF AUSTIN ANTI-DISPLACEMENT TASK FORCE 1 TABLE OF CONTENTS Letter of Transmittal Members of the Anti-Displacement Task Force Overview of the Report Our Charge Our Strategy Findings and Recommendations 1.Preserving and Expanding the Affordable Housing for Homeowners2.Preserving and Expanding Affordable Housing for Renters3.Preserving and Growing Small Businesses and Cultural Assets4.Identifying Financing StrategiesA Note on the Task Force Charge of Addressing “Income and Asset Creation” Conclusion Minority Report Relating to the Potential Impact of Increasing the City’s Homestead Exemption 2 LETTER OF TRANSMITTAL November 16, 2018 Mayor and City Council: The members of the Austin Anti-Displacement Task Force present this report in response to your charge. Our report sets forth our recommendations for solutions to the epidemic of displacement of Austin’s low- and moderate-income residents and residents of color from our neighborhoods and their growing exclusion from our city. Displacement is creating greater racial, ethnic and economic segregation which in turn increases economic, social and educational inequality in our city. At the first public hearing of the task force Mayor Adler stated that there will not be only one, but instead many solutions found that are needed to fix the problem of displacement. We have discovered that the mayor is correct. The task force has adopted 107 recommendations for action. All these recommendations merit implementation. While they cannot all be immediately implemented. The city council needs to begin and should eventually address them all. Displacement presents the most serious threat that we as a city face today. Displacement hurts the most vulnerable: the elderly, people with disabilities and lower-income Austinites. Because of our city’s long history of segregation and institutionalized racism, displacement’s effect on people of color is most severe and unjust. No city is great without economic and cultural vibrancy. If not immediately reversed, displacement will destroy Austin’s long-term desirability as a place to live, its culture and its quality of life. Displacement can ruin Austin’s economic competitiveness, hindering growth and development of small businesses and cultural assets, by cementing the growing perception that Austin is not a great, diverse, affordable city but instead, a city that promotes and values a monolithic culture in which only relatively young, economically comfortable white people live. It is hard to overstate the severity of this problem and the rapidity at which it is compounding. Despite long agonizing over it, as is evidenced by the myriad of reports (dating as far back as 1979) and the series of task forces that have made remarkably consistent recommendations to address displacement, our city has failed to act effectively to stop the destruction of historically ethnic neighborhoods, the widespread stripping of household wealth of lower-income homeowners and renters, especially people of color with low-incomes, and the loss of small businesses and cultural assets which has led to the ethnic and economic homogenization of our city. The public is frustrated with the lack of action. Respectfully, we urge the city council to focus on action rather than convening any more task forces on this issue. It is imperative that our leaders take the political risk to combat this injustice. That’s how change happens. The task force has devoted ten months to study and develop these recommendations to address displacement in Austin. A task force can sometimes be a way to study a problem; but we have heard 3 clearly at our public forums that repeated task forces are now viewed as a delaying tactic. No more delays. The dialogue process needs to give way to action. The University of Texas at Austin School of Architecture Uprooted report (September 2018) commissioned by City Council describes in detail the current state of displacement in Austin. The task force has reviewed this report and agrees with the findings. We urge the City Council to regularly update the status of gentrifying neighborhoods and refine the methodology by supplementing Census data with current real estate market data. It is critical that the city government maintain this accurate ongoing description of the nature and extent of involuntary displacement, so the problem can be understood, initiatives appropriately targeted, and the community can assess the progress from city initiatives like those we have recommended. The city council’s current focus on displacement and the underlying issues of integration, inclusion and diversity – ethnic, racial, economic and cultural – is appropriate and necessary. For decades, governmental action has been unfocused, poorly coordinated and had limited impact. It is important for city leaders to correct this legacy, particularly considering city government’s historical promotion of residential racial segregation. A solution will require the effort of more than just city government. While government was the legal entity responsible for enacting residential segregation, the business and real estate development community encouraged segregation, operationalized it and used it to their economic advantage. Gentrification of neighborhoods and the ongoing displacement of Austin’s citizens of color is simply the latest stage of the economic exploitation of the homes and neighborhoods of Austin’s poor and people of color. While government sowed the seeds of this evil by adopting Jim Crow residential segregation in 1929, it is the real estate community, and indeed the balance of Austin residents, who tended the fields and reaped its economic fruits. Displacement today is not simply the legally and morally neutral workings of Austin’s real estate market. Displacement and exclusion is the strange fruit of public policies put in place by city government to disadvantage citizens of color at the behest of and for the economic advantage of the white citizens of Austin. An appropriate solution will require significant public spending and bold policies. Support for these will require the widespread acknowledgement that what is happening in Austin today is rooted in an ongoing and unaddressed legacy of racism. An equitable solution demands that Austin plant a new crop of inclusive community building practices whose purpose is to cultivate an economically, ethnically and culturally diverse city. There are worthy examples of this work to be found in several Austin nonprofits and community development corporations. This must not simply remain the work of a few but become the responsibility of everyone. City government, the business community, philanthropic organizations and community led organizations must find the tools to share with people who want to do the work of weeding out Austin’s legacy of racial and economic exploitation once and for all. As demonstrated in the overwhelming support for the housing bonds by Austin voters this month, our city is ready to follow bold city council leadership to take up the tools and policies of corrective measures to ensure that Austin becomes a diverse and inclusive city for all. 4 Members of the Austin Anti-Displacement Task Force Raul Alvarez, Co-Chair Mayor Appointee Juliana Gonzales CM Kitchen Appointee Vacant CM Houston Appointee Ann Teich CM Pool Appointee Nefertitti Jackmon, Co-Chair Mayor Appointee John Henneberger Mayor Appointee Solveij Rosa Praxis CM Flannigan Appointee Vacant Mayor Appointee Yvette Crawford-Lee Mayor Appointee Shoshana Krieger CM Casar Appointee J.D. Rimann CM Troxclair Appointee Ed Wendler, Jr. CM Alter Appointee Alberto Garcia CM Garza Appointee Vincent Limon-Viteritt CM Renteria Appointee Ruby Roa MPT Tovo Appointee Bree Williams Mayor Appointee Diana Zuniga Mayor Appointee 5 OVERVIEW OF THE REPORT Based on our review of the displacement problem, we conclude a solution is within reach. It involves seven major initiatives: 1) Expanding public expenditures for housing affordability dedicated to low-income households, coupled with carefully crafted density increases that expand low- and moderate-income housing affordability. 2) Adopting government initiatives to produce more low- and moderate-income homes and provide housing access across the city linked to affordability goals and incentives for all Austin neighborhoods. 3) Placing an equal emphasis on the preservation of affordable housing as is given to new construction of affordable units. 4) Engaging our local business community and philanthropic institutions in developing resources to stop or mitigate displacement. 5) Challenging and overturning the unlawful usurpation by the Texas Legislature of the city’s home rule powers to promote housing affordability and inclusion. 6) Taking intentional efforts to preserve the diverse cultural legacy of small businesses and community assets. 7) Engaging, persuading and empowering Austin citizens, neighborhoods, developers, businesses and philanthropic organizations to act to increase the city’s economic, ethnic and cultural diversity. This will require significant leadership and support for a civic infrastructure and financial incentives to empower citizen action for citywide and neighborhood diversity. Through investments, value shifts, incentives and activism, Austin can instill a community ethic of diversity and cultural inclusion in much the same way our city debated, adopted and came to embrace environmentalism and the Austin live music scene. Our 107 recommendations provide policies and actions that the city council will wish to consider in implementing these seven broad initiatives. The appropriate balance of initiatives and actions must be decided by a determined city council who desire to make Austin a livable city for all residents. Any attempt at a solution that fails to address each of the seven initiatives outlined above and that fails to broadly engage and win the support of citizens, neighborhoods, developers, businesses and the philanthropic community will fail. 6 OUR CHARGE Review and recommend the specific strategies in five categories of action, which include: ● Preserving and expanding the supply of affordable housing; ● Controlling land for community development; ● Preserving and growing small businesses and cultural assets; ● Income and asset creation by providing needed services - child care, transportation, a basic retail sector, access to health care, and employment opportunities - as a precondition for success; and ● Financing strategies to provide community- specific ways to fund the other four categories of action. The task force will commit to a 10-month process that will culminate in identifying sources of information that will reveal the depth of the problem in our communities, set metrics and goals, and give preliminary recommendations for displacement prevention. 7 OUR STRATEGY The Anti-Displacement Task force divided into four different working groups which included: ● Preserving and Expanding the Supply of Affordable Homeownership Opportunities ● Preserving and Expanding the Supply of Affordable Housing for Renters ● Preserving and Growing Cultural Assets and Small Businesses ● Identifying Strategies to Finance the recommendations With approximately 56% of Austin’s households being renters, and an even greater proportion of low-income Austinites being renters, we determined that it was imperative that we address the housing needs of renters separately. This is especially true since renters have historically been overlooked in conversations surrounding displacement and the allocation of resources to combat it. `Additionally, the housing challenges that homeowners and renters face are unique and require separate solutions. Although we had a working group that was focused primarily on developing financing strategies for all recommendations, each group worked independently to identify financing strategies along with their recommendations. There might be similar recommendations in each group. We did not delete any duplicate and/or similar recommendations. The duplication indicates similar challenges among homeowners, renters and even small businesses. During our meetings, much of our time was spent hearing from city staff, the community and industry experts on the challenges faced by homeowners and renters. Little discussion addressed the unique challenges faced by small business owners and those responsible for preserving and promoting the cultural assets throughout the city. However, many of us agreed that business and cultural assets are directly impacted by the surrounding community. Businesses are often attracted to certain neighborhoods because they are seeking to serve a particular demographic. Likewise, cultural assets are often reflective of the community in the immediate vicinity and address a specific community need. Our theory was that businesses and cultural assets are generally characteristic of the surrounding population. The challenge that Austin is now facing is the shifting demographics of historically ethnic communities. According to a 2010 U.S. Census report, East Austin experienced a 444% increase in its majority white population while during the same time, there was a 65% decrease in the African American population. As a result, East Austin is facing a major challenge to its historic cultural identity; the loss to Austin’s ethnic diversity is evident and will continue to be impacted without governmental intervention. Our desire is to provide recommendations that will help to keep people in place who desire to reside in their homes and communities throughout the city, so that communities do not face the same mass displacement as is the case in East Austin. 8 Preserving and Expanding Affordable Housing for Homeowners The task force echoes the previous observations of the Mayor’s Task Force on Institutional Racism and Systemic Inequities in the “Real Estate and Housing” section of the report: We believe housing affordability is the number one political issue in Austin today. It is a crisis that affects people regardless of race, but the shortage has had a profoundly disproportionate impact on Blacks and Hispanics/Latinos. There is an important and challenging nexus between housing affordability and racial justice in our city. Austin must acknowledge the inseparability of these problems and start to consider both issues together. … The working group does not believe that the market (even a highly incentivized one) can address such a substantial affordable housing shortfall. (Mayor’s Task Force on Institutional Racism and Systemic Inequities, page 22) This Task Force’s recommendations relating to homeownership begin with a reiteration of the need for a “Right to Remain and Right to Return” policy. Subsequent recommendations are strategies that support the attainment of that goal in areas experiencing displacement and in the City as a whole. The Task Force recommends the development of new measures providing tax relief to low-income homeowners and to identify new public and private funding sources that can be used to preserve and enhance affordable homeownership opportunities in areas experiencing displacement. Adopting a policy for capturing about one-third of the tax increment collected through the use of Tax Increment Financing is a source of funding to preserve and expand affordability. The task force also suggests development of an “Opportunity Fund” program that would be privately funded and which would thus have more flexibility in terms of the activities that could be supported. In additional, prioritizing the use of City-owned land for the development of affordable housing with permanent affordability restrictions (a land bank), particularly on large tracts that are centrally located, is critical. The Recommendations from the Task Force are as follows: I. Adopt and implement programs to support the implementation of a “Right to Remain and Right to Return” policy.1 A. [Recommendation 1] Develop and adopt a “Right to Remain and Right to Return” policy. B. [Recommendation 2] Develop policies and programs to support residents at risk of displacement and outreach strategies to effectively connect these residents with available resources, particularly those included in this report from the Anti-Displacement Task Force. C. [Recommendation 3] Previously displaced residents should be prioritized: on waitlists for City financed, incentivized, and endorsed housing; and for programs that are designed to assist first-time homebuyers. 1 This recommendation aligns with Resolution #2 of “The People’s Plan” and is a major theme in the recent report from the Guadalupe Neighborhood Development Corporation: Right to Remain: Montopolis Neighborhood. 9 II. Increase public understanding, awareness and support to address displacement A. [Recommendation 4] The City should partner with a non-profit organization to develop a one-stop-shop (e.g., Office of Housing Stability) to: (i) integrate all assistance programs, simplify processes and develop a targeted outreach program to ensure that seniors, low-income homeowners, long-time homeowners and disabled homeowners in neighborhoods experiencing displacement: ● Are taking full advantage of all exemptions/rebates relating to taxes & utilities; ● Receive assistance regarding property sales/transfers to protect equity/assets of homeowners; ● Receive assistance with probate and estate planning; ● Are able to access home repair programs; and ● Receive support from NHCD’s financial empowerment program. ● Understand options relating to property tax deferrals. (ii) connect homeowners and renters with displacement assistance and resources. (iii) conduct outreach and education to the public on housing and development issues. (iv) connect with non-profits and academic institutions involved in displacement work. B. [Recommendation 5] Partnering with service providers providing services to seniors (e.g., Meals on Wheals) to reach seniors where they live; and via regular presentations at senior centers and neighborhood centers; working with Texas Rio Grande Legal Aid, the Texas Legal Service Center, local higher education partners and other non-profit partners to organize legal clinics and one-on-one counseling and resources to help seniors with probate and estate planning. C. [Recommendation 6] Request that Travis County Appraisal District develop a proactive mechanism by which to identify and notify homeowners who do not have a homestead exemption but who may qualify for that exemption. III. Consider new or expanded tax exemptions/abatements to assist long-time and/or low-income homeowners in neighborhoods experiencing displacement. A. [Recommendation 7] Consider the possibility of granting special senior and/or homestead tax exemptions to help address instances where seniors or low-income homeowners face a demonstrable inability to pay property taxes, putting them at risk of displacement. B. [Recommendation 8] If tax exemption measures identified in IV-A require legislative action, then pursue those actions during the next legislative session. C. [Recommendation 9] Seniors can be automatically enrolled for the older-adults tax exemption if the appraisal district has their birthdate on file, so Task Force recommends that: (i) the City of Austin work with the appraisal district to develop a form that 10 homeowners can submit to officially have their birthdate on file; (ii) assist long-time homeowners that currently do not have an older adults exemption to help them submit the form that ensure that this exemption is instituted automatically when they are eligible. D. [Recommendation 10] Establish a tax abatement program for homeowners and other property owners in “reinvestment zones” as authorized and defined in the Texas Tax Code. The program requires that a homeowner participate in a home repair program.2 E. [Recommendation 11] Establish a senior volunteer tax break coupled with a senior volunteer program. Per Texas Tax Code, the City and County can partner to provide volunteer opportunities to low-income seniors in exchange for the senior homeowners’ property taxes being forgiven. Pursue legislation that allows the City/County to set the dollar value of each hour of service and not have the value default to the federal minimum wage. When pursuing legislation, seek to include a clause that allows a community member to volunteer on behalf of a homeowner who is not able to volunteer but who needs the tax assistance.3 F. [Recommendation 12] Develop a Neighborhood Stabilization Overlay (also called a Neighborhood Conservation District) requiring new development to meet standards more stringent than the baseline zoning standards as a way of respecting neighborhood scale and character (i.e., slowing or prohibiting out-of-scale development that is occurring).4 IV. Develop initiatives and expand funding sources to support affordable housing production and preservation and ensure that adequate resident protections are in place. A. [Recommendation 13] Develop an “Opportunity Fund” run by a non-profit entity or community foundation that can serve as a private fundraising vehicle that may be used by developers, real estate agents, neighborhood residents/businesses and other others who wish to mitigate displacement to provide support for: long-time, low-income homeowners and renters; iconic/legacy businesses; and the preservation of cultural/historic resources. B. [Recommendation 14] Establish a Neighborhood Stabilization Loan Program to assist vulnerable low-income homeowners to provide long-term, low-interest loans to low-income homeowners who are paying for more than 30 percent of their income on housing. The loans could be forgivable in exchange for the homeowner agreeing to a longer-term affordability restriction, ensuring that the home would be sold to another low-income owner and remain owner-occupied.5 C. [Recommendation 15] Make ongoing significant investments in the creation and preservation of affordable housing through the City’s bond program, with an ultimate goal of reaching $300 million in bonds dedicated to affordable housing per bond cycle.6 2 This recommendation is more extensively described in the University of Texas Study, Uprooted, on page 67. 3 This recommendation is more extensively described in the University of Texas Study, Uprooted, on page 68. 4 This recommendation is more extensively described in the University of Texas Study, Uprooted, on page 76. This recommendation aligns with Resolution #5 of “The People’s Plan”. 5 This recommendation is more extensively described in the University of Texas Study, Uprooted, on page 67. 6 This recommendation aligns with Resolution #1 of “The People’s Plan”. 11 D. [Recommendation 16] Continue to support home repair assistance programs for low-income homeowners to prevent their involuntary displacement stemming from housing habitability problems. E. [Recommendation 17] Require that 85% of bond funds approved for affordable housing target families whose income is 50% MFI or less with at least half of these funds being targeted to families at earning 30% MFI or less. F. [Recommendation 18] Significant investments in land acquisition, affordable housing production and preservation should only be approved if there is a guarantee for long-term affordability. G. [Recommendation 19] Invest at least 30% of revenues generated through all Tax-Increment Financing (TIF) Districts in the City of Austin be dedicated to creating and preserving affordable housing as currently done by the City of Houston. H. [Recommendation 20] Investment of $16 million in general fund dollars in the Housing Trust Fund, including the requirement that all funds target households making 60% or less of median family income.7 I. [Recommendation 21] Support the ability of low-income homeowners to build an accessory dwelling unit by easing land restrictions and viable financing options.8 J. [Recommendation 22] Allow homeowners to subdivide and sell a portion of their lots while remaining in place. This option helps them to remain in place, generate from sale of the additional lot, and reduce the tax obligation for their homestead.9 K. [Recommendation 23] Establish a mobile home park resident acquisition program through resident acquisition and management.10 V. Prioritize City-owned land for the development of affordable housing, particularly large tracts and tracts located within three-miles of the central business district. A. [Recommendation 24] Use community land trust as a way of preserving existing affordable housing units as well as to ensure long-term affordability of new affordable housing units.11 B. [Recommendation 25] Establish a City-controlled or joint City/County controlled community land trust (e.g., Austin Land Assemblage Authority) that can facilitate affordable housing development on publicly-owned property as well as on land acquired for the purpose of developing affordable housing. This City or City/County land trust can serve as a safeguard to community land trusts operated by non-profit entities, should those entities dissolve or choose to discontinue management of a community land trust that they control. 7 This recommendation aligns with Resolution #1 of “The People’s Plan. 8 This recommendation is more extensively described in the University of Texas Study, Uprooted, on page 70. 9 This recommendation is more extensively described in the University of Texas Study, Uprooted, on page 70. 10 This recommendation is more extensively described in the University of Texas Study, Uprooted, on page 70. 11 This recommendation is more extensively described in the University of Texas Study, Uprooted, on page 88. 12 C. [Recommendation 26] Establish an advisory board for the City or City/County community land trust. This advisory board will provide oversight of the City or City/County community land trust and suggest performance standards for community land trusts that are run by non-profit organizations. D. [Recommendation 27] The City (or City/County if applicable) will ensure that certain legal provisions are included in order to safeguard the interests of local government as well as to ensure that homeowners’ access to mortgage financing or security of tenure are not jeopardized, including provisions that: outline what happens in the event of default of an entity managing a community land trust; provide an opportunity for an entity managing a community land trust to cure problems that may lead to default; outline the remedies that are possible should problems remain unresolved; and stipulating that the rights of the owners and their lenders will be honored if the ground lease is transferred from non-profit land trust to a city or city-county controlled land trust. E. [Recommendation 28] Identify publicly-owned property (city, county, school and state) that may be used for affordable homeownership and affordable rental opportunities, particularly tracts greater than 2 acres and located within 3 miles of downtown.12 F. [Recommendation 29] Consider designating some of the tracts identified in VI-E and located in gentrifying areas as parcels that may be used for the establishment of new mobile home parks, for example the undeveloped City-owned land/campus on Levander Loop. G. [Recommendation 30] Require a formal assessment of the “affordable housing potential” for city-owned property meeting criteria in IV-E as well as a formal “release” by Mayor and Council before such a tract may be sold or before the use of any such property may be changed. H. [Recommendation 31] For all city-owned property greater than two acres, utilize criteria used in the development of the “Villas on 6th Street” project, specifically that: (i) the city will retain ownership of the land and lease it to the developer or subsequent entity controlling the project; at least half of the units will be made available to families earning 50% MFI or less; and that the affordability period will be at least 50 years. Additional affordability (beyond half of the housing units) may be leveraged using housing bonds and tax credits. I. [Recommendation 32] Re-evaluate undeveloped property at Mueller to see if deeper affordability and a longer period of affordability can be secured. J. [Recommendation 33] In discussion with other public entities about government-owned tracts of land, such as the Lions Golf Course, ensure that a variety of community needs, like the need for affordable housing, are considered when considering redevelopment options. VI. Maximize the impact that established and future Homestead Preservation Districts (HPDs) can have by increasing the percentage of City tax revenues that will be deposited in the tax increment fund. 12 This recommendation aligns with Resolution #3 of “The People’s Plan”. 13 A. [Recommendation 34] Increase the percentage of the City tax revenues into the tax increment fund of the existing Homestead Preservation District from 10% to 30%, consistent with the recommendation in Recommendation 3(c) [Is this reference correct?] above. B. [Recommendation 35] For any new HPD’s that are established, set the percentage of the City tax revenues that is to be deposited into the tax increment fund at 30%. VII. Work to ensure the regulations that govern new development do not create an environment that is ripe for or exacerbates displacement. A. [Recommendation 36] In areas having a degree of gentrification with a “Late,” “Dynamic,” or “Early Type 1” designation in the recent UT study entitled Uprooted, do not allow any changes that increase density unless those zoning changes are tied to the provision of affordable housing. B. [Recommendation 37] The adoption of a new land development code should not have the impact of increasing density in areas having a degree of gentrification with a “Late,” “Dynamic,” or “Early Type 1” designation in the recent UT study Uprooted, unless those zoning changes are tied to the provision of affordable housing. C. [Recommendation 38] Whenever there is a change to existing flood plain maps, the city must immediately conduct a demographic analysis of residents whose properties will be added to the flood plain or, if already in a flood plain, whose flood plain designation is intensifying. D. [Recommendation 39] Whenever there are changes to existing flood plain maps, the city must immediately assess the economic impact caused by the corresponding need for flood insurance and work to mitigate the impact of that change by providing needed assistance to low-income homeowners, such as assistance in purchasing flood insurance. E. [Recommendation 40] Identify areas that have experienced flooding in the last five years in the watersheds (i.e., Onion Creek, Williamson Creek, Boggy Creek and Walnut Creek), establish interim development regulations for those areas that flooded, assess drainage areas and condition of stormwater infrastructure, and develop/fund improvements to drainage areas and stormwater infrastructure to address problems with flooding.13 F. [Recommendation 41] If modifications are made that move homes into a designated flood plain or that designate the hoes to be in an area at a higher flood risk, the city should establish a program to provide financial assistance to lower-income homeowners to assist them in the purchase of federal flood insurance. VIII. Assist homeowners to avoid displacement from predatory mortgage financing. 13 This recommendation aligns with The People’s Plan Resolution #4 14 A. [Recommendation 42] Monitor wrap around and other predatory mortgage lending and establish a financial assistance program to assist homeowners at risk of displacement due to predatory lending practices. 15 Expanding and Preserving Affordable Housing for Renters Renter households are the households most vulnerable to displacement and protections and resources for renters must be prioritized in any effort to meaningfully impact displacement in Austin. Not only do renters make up the majority of Austin households (56%), the lowest-income Austinites also are predominately renters (75% of households earning less than $50,000 a year are renters) and those who are housing-cost burdened are disproportionately renters (almost 50% of renters are cost burdened compared to 25% of homeowners). Black Austinites and Latinx Austinites are more likely to live in a renter household than a homeowner household (73% of Black Austinites, 68% of Latinx Austinites. These patterns are in large part a product of institutionalized racism and historical segregation that has created barriers to acquiring land and building wealth. These residents are now on the front line of displacement, most often not having any claim to stay in their homes as market pressures increase. Austin needs both the political will and the tools to combat displacement. Building the political will requires making more people see why attacking displacement is in their interest. Ideas for accomplishing this are outlined under topic I below. As far as tools go, there are a number outlined under topics II and III below. There is no simple solution to this problem. Additionally, because there will be no quick fixes to our displacement problem, we must ensure that Austinites who are directly impacted by displacement get as much support as possible to mitigate the effects of displacement. These recommendations are outlined in Topic IV. * = following a recommendation means it mirrors a recommendation In the UT Gentrification Study Uprooted. The Recommendations from the Task Force are as follows: I. Increase public understanding, awareness and support to address displacement A. [Recommendation 43] Make Austin the national center for “neighborhood affordability, integration, diversity and inclusion" by: i. Establishing a Joint Center for Urban Affordability, Integration, Diversity and Inclusion at the University of Texas, Huston-Tillotson University and St. Edward’s University, with an extension program working in Austin’s neighborhoods for students to work with residents to learn, teach and innovate. ii. Support Austin neighborhood directed programs to serve as living laboratories for neighborhood and housing equity and inclusion. iii. Train and fund neighborhood-based CDCs, to engage people of color, persons with disabilities, persons of all incomes, developers, architects, planners and community leaders to develop and carry out neighborhood level initiatives to achieve integration, diversity and inclusion. B. [Recommendation 44] Invest public dollars to support tenant engagement and organizing around housing development so that residents know where they can go and are aware of the existing resources that they can leverage well before a displacement event occurs.* 16 C. [Recommendation 45] Continually update UT Gentrification study maps as new census and real estate market data comes out and continuously conduct deep-dive analyses for all gentrifying and at-risk neighborhoods. D. [Recommendation 46] Undertake a campaign to encourage Austinites to embrace the values of affordability, integration, diversity and inclusion at the neighborhood and city levels. E. [Recommendation 47] Implement rental registration to track the location, occupancy, ownership information, and number of rental units, so that displacement patterns can be identified and monitored. F. [Recommendation 48] Work with the Texas Legislature to expand protections for tenants from displacement that are available to tenants in many other states. These protections include: just cause evictions, anti-retaliation and anti-harassment, providing tenants an opportunity to cure lease violations (except non-payment) and guaranteeing tenants a right to organize. G. [Recommendation 49] Aggressively advocate for and zealously defend Austin’s core values of diversity, integration and community by ensuring that the City Law Department retains senior counsel specializing in housing justice matters and the City Council should avail itself of outside legal counsel specializing in housing law who would report directly to the City Council. II. Adopt initiatives to support affordable housing production and preservation with adequate resident protections A. [Recommendation 50] Only invest in land acquisition, affordable housing production, and preservation where there are guarantees of permanent affordability. Wherever possible, the City should retain ownership or control of land or ensure that a Community Land Trust or similar entity with a commitment to permanent affordability retains ownership or control. B. [Recommendation 51] Prioritize investing in units for the most underserved populations according to regular housing market analysis. Public funds should not be used to invest in housing that the market is already sufficiently providing. Currently, this means investment should be directed at housing with deep affordability serving families at or under 30% AMI. C. [Recommendation 52] Do not take actions that shift the tax burden to renters and small businesses such as increasing the homestead exemption. Any property tax relief should be targeted to populations at risk of displacement. The Mayor should take the initiative to bring together the mayor of other Texas cities that face displacement challenges related to property taxes with the purpose of developing recommendations for the legislature to provide targeted property tax relief for affordable rental housing and low-income homeowners. 17 D. [Recommendation 53] Work with the Travis County Tax Appraiser to explore alternative assessment approaches to rental housing, in accordance with Texas law which permits an income-based appraisal approach to be utilized when the owner has committed to charge substantially below market rents.* E. [Recommendation 54] Assess the feasibility and legality of providing more robust protections to Austinite renters and implement such protections to the greatest extent possible. Possible protections include just cause eviction protections, anti-retaliation and anti-harassment protections, an opportunity for tenants to cure lease violations,, and a right to organize. * F. [Recommendation 55] Any rental property which benefits from City dollars, a City endorsement or City incentives must have a standardized set of robust tenant protections including just cause eviction, an opportunity to cure alleged lease violations, an opportunity to rent regardless of source of income, limited tenant screening, and requirements for notice prior to entry.* G. [Recommendation 56] Enact an Eviction Notification Ordinance where landlords will be required to notify the City when they intend to evict a substantial number of a property’s leases in less than a year period.* H. [Recommendation 57] Implement a Tenant Opportunity to Purchase Program akin to the successful program operating in Washington DC. This program is the subject of detailed study in the UT Uprooted report to the city council. This program should provide tenants in multifamily properties or a tenant-designated nonprofit the right of first refusal upon the sale of their property. The City should fund such a program, including money to help finance purchases, organize tenants, and provide technical assistance to resident-owned properties.* I. [Recommendation 58] Implement a Troubled Buildings Program similar to Chicago’s Troubled Building Initiative to ensure that landlords do not profit off of neglecting maintenance in their buildings and that there are responsible landlords available to act as receivers or purchasers if owners of neglected properties fail to adhere to compliance timelines. J. [Recommendation 59] Adopt a Community Benefits Agreement Ordinance that which would require that all large projects that receive business incentives through the City to mitigate the impact of the project on vulnerable neighborhoods and populations and engage in a Community Benefits process. K. [Recommendation 60] Ensure that Austin renters have equal access to Austin Energy programs. Multifamily Renters often receive utility services that are sub-metered and allocated and they, therefore, do not qualify for Austin Energy customer assistance programs. The City should provide the same financial assistance that would be available to a homeowner or a single-family renter to multifamily renters. Similarly, multifamily renters should equally benefit from weatherization programs. 18 L. [Recommendation 61] Preserve and expand the supply of existing public housing and other forms of government subsidized housing. Austin’s public housing has provided essential housing for Austinites with low-incomes since the 1930’s. This is an example of a public “investment” strategy in permanent affordable housing that the task force strongly recommends. The affordability permanency of public housing is of immense importance. The location of several public housing developments in what are today gentrifying neighborhoods also increases the importance of the existing public housing stock. The Austin Housing Authority and the Austin City Council should insist on the rigorous maintenance and preservation of this critical community asset as well as seeking opportunities to expand the city’s supply of permanent affordable housing. When public housing is redeveloped, ensure that there is no net loss of affordability in terms of number of units and the income levels served. M. [Recommendation 62] Preserve existing subsidized affordable housing stock by monitoring properties at-risk of leaving affordability programs, informing residents, housing advocacy groups and the public of potential losses, and identifying resources necessary to aid in preservation efforts. The City should prioritize investing in and securing financing for properties at-risk of losing affordability, including through purchasing properties during rights of first refusal and qualified contract periods.* N. [Recommendation 63] When demolition of existing multi-family units is proposed as part of the redevelopment project, work to ensure that there is no net loss of affordable units and that at least one half of the new project’s unit are affordable as defined as the pre-redevelopment rent levels. O. [Recommendation 64] Enforce the Short Term Rental Ordinance in multifamily housing to ensure that multifamily units are not being removed from the rental market. III. Adopt initiatives to support integration, diversity and inclusion in housing Preventing displacement of the poor and creating a diverse and inclusive Austin should be every citizen’s and every neighborhood’s obligation. The task force recommends the adoption of neighborhood “fair share” goals and plans in order to stabilize the supply of affordable housing and dismantle patterns of racial and economic segregation. The following initiatives should be adopted as the basis of an Austin fair share and inclusion initiative. A. [Recommendation 65] Carry out an Assessment of Neighborhood Equity (ANE) for each neighborhood which will include an analysis of affordability, integration, diversity and inclusion, public services, and schools. B. [Recommendation 66] Create fair share policies for each neighborhood. Identify affordability, integration, diversity and inclusion goals for each Austin neighborhood. Require neighborhoods to adopt a workable plan to meet their goals. Link future neighborhood density protections, public investments in parks, libraries, other improvements to the achievement of these goals. Provide incentives in CIP funding, and code protections to encourage residents of those neighborhoods to develop and carry-out initiatives to achieve neighborhood affordability, diversity and inclusion 19 goals. If neighborhoods do not voluntarily adopt and implement a workable plan, then the city would prioritize up zoning requests and density bonuses requested by nonprofits and for profits who propose to develop affordable housing in those neighborhoods. C. [Recommendation 67] Work with nonprofits and for profits to affirmatively market housing, both renter and owner-occupied, to people of color and people with disabilities in both gentrifying neighborhoods and in traditionally segregated white neighborhoods. D. [Recommendation 68] Aggressively enforce Fair Housing laws. Fair Housing enforcement in Austin is currently inadequate. Enforcement should be directed against the two types of Fair Housing violations: 1) transactional discrimination between two private parties; and 2) systemic discrimination that results in patterns and practices of unlawful residential segregation. Transactional discrimination can be very subtle and difficult for home seekers to detect. And when it is not detected, it is not reported. The low levels of fair housing enforcement activities on the part of the Austin Human Relations Commission are a result of passive enforcement of Fair Housing laws which is solely complaint driven. The City should increase funding to more effective programs by the Austin Tenants Council to proactively conduct fair housing testing investigations to identify, document, and eliminate systemic housing discrimination. The City’s goal should be to expand the Austin Tenants Council Fair Housing Program to provide Austinites with a best practice, proactive Fair Housing testing enforcement program modeled after the Fair Housing Justice Center of New York City. Assessment and combating systemic discrimination an ongoing responsibility of the city. The City’s Analysis of Impediments to Fair Housing is the vehicle for assessment and the document that sets forth the city’s strategy to combating systemic discrimination. The City Council should hold an annual work session to assess the state of Fair Housing in Austin and to make necessary changes to the transactional testing, systemic assessment and policies and enforcement. The City must aggressively root out all vestiges of housing discrimination through active Fair Housing law enforcement actions based on a program of assessment, testing, diligent investigation and prosecution. E. [Recommendation 69] Implement a program with uniform tenant eligibility standards, a central application process, and waitlist procedures for all City-financed, endorsed and incentivized housing.* F. [Recommendation 70] Increase opportunities for low-income residents in gentrifying communities to participate in planning and development processes. Ensure that all residents know about and are invited to participate in meaningful discussions related to development in their neighborhoods. Meetings should be conducted in the neighborhoods, during evenings and weekends, and interpreted into all languages spoken in the area. G. [Recommendation 71] Adopt Small Area Fair Market Rents for Section 8 voucher holders. 20 H. [Recommendation 72] Adopt regulatory changes to treat manufactured housing has real estate rather than personal property. I. [Recommendation 73] Through both legislative advocacy and through the courts defend Austin’s right to enact policies and ordinances to combat residential segregation and to support "integration, diversity and inclusion of everyone.” Start by mounting aggressive challenges to State of Texas legislative actions infringing on Austin’s ability to use inclusionary zoning, linkage fees and prohibition of source of income fair housing protection. IV. Adopt initiatives to mitigate displacement’s effects on Austinites A. [Recommendation 74] Immediately fund the City of Austin relocation assistance program so that relocation payments can be promptly given to eligible families and the contemplated nonprofit agency can begin aiding affected families, conduct the needed nexus study, amend the relocation ordinance to include a lookback period for tenants who lived in units for one year prior to a permit or site plan request, and explore further methods to ensure that the effects of displacement are mitigated and families who wish to can remain in Austin, including rapid response supportive services.* B. [Recommendation 75] Increase funding for emergency rental assistance and increase awareness of assistance resources, through outreach programs.* C. [Recommendation 76] Fund programs to support Austinites in navigating eviction proceedings and in negotiating appropriate settlements that minimize the impacts of eviction.* D. [Recommendation 77] Prioritize previously displaced residents on waitlists for City-financed, endorsed, and incentivized housing. E. [Recommendation 78] Austin Energy should waive set up fees and deposits for previously displaced tenants. Past arrears and the need for a down payment should not be a barrier to connecting services. Austin Energy should designate staff to assist displaced tenants in navigating the process. Many displaced tenants are unable to procure housing in the City of Austin because of barriers to reconnecting utilities because of past expenses. 21 Preserving and Growing Small Businesses and Cultural Assets Communities are unique places where individuals first begin to gain their personal identity and their interconnectedness to the world. A strong community is often characterized by a stabilized housing market, long standing businesses and vibrant and accessible cultural offerings. Along with educational institutions, these are the assets that serve as the nexus and the safety net of thriving communities. Cultural production generally happens organically, in the context of how people live. Whether people are gathering to worship together, or young children are joining one another for a game of double-dutch, authentic cultural experiences aren’t manufactured, they are created naturally as people go about their daily habits. Culture is the sum of people’s traditional celebration which mark important milestones from birth to death. Cultural celebrations and recognition is how we keep our rich cultural heritage alive. Positive memories are created in the context of community which help to build cultural and civic pride. A healthy community contributes to the stabilization and growth of the business and cultural assets that dominate any given neighborhood. With the displacement of people, there is often the corresponding displacement of businesses that have served as the anchors in many communities. The loss of legacy businesses and other cultural institutions creates gaping holes in the cultural, social and emotional fabric of a communities’ identity. The greatest stabilizing force to cultural and business displacement, is stabilizing the housing market. Austin can take bold steps to address the housing affordability crisis. It prides itself on being innovative, progressive, and city leaders are seeking to find solutions to address these difficult problems that we’ve been grappling with for more than 20 years. The solution is not to be timid in taking corrective actions, but to take bold steps to halt the further displacement of people, businesses and cultural assets to ensure that Austin’s future boldly embraces the diverse narratives of the many citizens who desire to call Austin home. Current policies have not promoted inclusive growth and development among all segments of our city, and for too long, obstacles were created that limited the capacity to build wealth for certain populations. It is only equity, in: funding, investment and policies, that will strengthen the social, economic, cultural and educational fabric of this city that will allow Austin to be representative of the best that America has to offer. Austin is a special place, for those who have grown up here and for recent arrivals, however, it is changing right before our eyes. The story of what’s taking place to communities with STAGE 4 (UT’s Report) displacement, is also occurring in cities across the nation. Yet, research says great cities value inclusiveness, social integration, and affordable housing, and insist on opportunity for all. Austin prides itself in being a great city. It is with the anticipation of reaching that great end that we have drafted the following recommendations that we hope will not only be adopted by City Council, but also enacted by staff to ensure that we protect and preserve our small businesses and cultural assets that have been, or that have the potential to be, the greatness of Austin’s hallmarks. 22 The Recommendations from the Task Force are as follows: I. [Recommendation 79] Provide dedicated bond funds and other sources of funding to establish a robust cultural land trust with a priority to be given to communities facing late stage gentrification. II. [Recommendation 80] Use the disposition of surplus City-owned land, and through partnerships with private, nonprofit and local government entities, to establish a robust cultural land trust. (Chapter 253 Local Government Code allows for this). III. [Recommendation 81] Create a robust cultural land trust to be implemented within one year to be operated as a joint venture as a public-private partnership with city, philanthropic, corporate and nonprofit arts leaders. The cultural land trust will provide: a. Affordable housing for artists; b. Studio, office, practice and performance space for artists. IV. [Recommendation 82] Expand use of Neighborhood Conservation Combining Districtsand Historic Districts to preserve Austin's historically black and brown communities, with an immediate priority on communities experiencing continued loss and late displacement. V. [Recommendation 83] Provide a complete analysis of current economic development incentives to recommend changes to these programs to make them more meaningful for small businesses (including individual entrepreneurs, music venue operators, and cultural/arts organizations). VI. [Recommendation 84] Create a legacy business registry, whose oversight would be jointly shared by the Economic Development Department and the Historic Preservation Office, to protect legacy businesses and institutions that are important cultural assets to Austin’s identity. VII. [Recommendation 85] Instruct the Economic Development Department to complete a third-party analysis of current fees and ordinances that small businesses are charged by the City of Austin to establish the true annual cost of doing business in Austin; the findings are to be prepared in a report and are to include how collected fees are spent. VIII. [Recommendation 86] Provide funding for two permanent, full-time employee ombudsperson, to be housed in the Economic Development Department, who will be responsible to assist existing small businesses (including individual entrepreneurs, music venue operators, and cultural/arts organizations) in navigating city requirements for operating and doing business to be hired within 1 year with a targeted focus on assisting minority owned businesses. IX. [Recommendation 87] Complete an analysis of City owned cultural and recreational facilities to determine the greatest needs throughout the City and begin implementing a process by which all City owned cultural facilities are maintained for the benefit of the community at a level that is equitable throughout all districts. 23 FINANCING STRATEGIES to PROVIDE COMMUNITY -SPECIFIC WAYS to FUND the OTHER CATEGORIES of ACTION Combating displacement and gentrification requires affordable housing. Displacement is thus ultimately a financial problem. Most initiatives recommended by the Task Force on Institutional Racism, “Uprooted”, the recent UT study, and this Task Force require funding that is not currently being made available. For example, a land banking initiative without a source of funds to purchase land is not a solution. The amount of funds that will be required to impact displacement is significant. The Austin Strategic Housing Blueprint estimated that addressing the shortfall in affordable housing over the next 10 years will require $4 to $6 billion dollars. If the City of Austin is serious about addressing displacement it must come up with additional sources of public funding. The scope of the current city housing investment is low relative not only in terms of the need, but also in comparison to other cities facing this challenge. HUD requires that all cities receiving federal housing dollars file annual action plans describing both federal and local sources of funding. Austin’s 2017 HUD action plan shows the city spending $15 of local resources per city resident. This amount includes $10 million from the 2013 housing general obligation (GO) bond issue which has since been exhausted. Without the GO bonds Austin spends only $4 per capita for housing. In contrast, in their 2017 action plans, Denver reports spending $34 of local funds per capita; Philadelphia, $37; Boston, $68; Seattle, $115; Portland, $186; and San Francisco, $536 per capita. In Texas, state law limits the type of local sources of funding that a municipality may use to fund affordable housing. The principal source of permitted funding is the property tax. Property taxes will always be an important part of the revenues available for affordable housing production and preservation. But a near exclusive reliance on property taxes cannot produce revenue sufficient to meet the housing need. High demands on property taxes for creation and preservation of affordable housing has an impact on the housing affordability of the persons paying property taxes. Overcoming the state-imposed restrictions on type of revenue sources permitted to be used for housing, restrictions enacted at the behest of organized special interests over the past few years is critical. Actions the city should to overcome these legislative restrictions are discussed in other sections of this report. Austin voters ‘approval of a $250 million general obligation bond for housing is a big step in the right direction. Yet overall, Austin is significantly underfunding affordable housing relative to comparable cities and addressing the funding problem is a requirement for carrying out all of the recommendations in this report. The Recommendations from the Task Force are as follows: I. Local Sources of RevenueThere are four ways property taxes can be used a source of funding for affordable housing: A.allocate tax revenue from the general fund to housing efforts;B.redirect tax revenue for housing before the taxes are deposited into the general fund; 24 C. waive or reduce property taxes before they are collected; and D. sell bonds to bring future tax revenue forward for investment today. A. Allocate tax revenue from the general fund to housing efforts. 1. [Recommendation 88] Make funding affordable housing a core city service around which the city budget is structured. 2. [Recommendation 89] Direct the city manager to prepare the next year’s budget with the priority of allocating $16 million for housing programs over and above bond proceeds. This funding level is reasonable. $16 million is roughly equal to the revenue generated by $.01 of the tax rate. As a comparison, Austin budgeted roughly $13.7 million in FY 2018 and $11.3 million in FY 2019 for economic development incentive payments. 3. [Recommendation 90] Set a budget policy that for the next five years the additional tax revenue generated by new development be allocated to achieving a $16 million goal. This can be achieved by directing tax revenue from new development into housing expenditures. For FY 2019 the additional tax revenue generated by new development is projected to roughly equal $16.5 million. 4. [Recommendation 91] City staff estimates that roughly $3 million dollars in fees are waived annually for the Smart Housing Program. These waivers usually provide short-term (5 year) affordability for households above the populations most vulnerable to displacement. Rather than budget for Smart Housing waivers, the city should dedicate an equal amount for targeted anti-gentrification investments that provide permanent affordability for displacement-vulnerable households at lower income levels. B. Redirect tax revenue for housing before the taxes are deposited into the general fund. In FY 2019 Austin is projected to collect roughly $52 million more in property taxes due to increases in property valuations. As noted earlier, roughly $16.5 million is from new development. Tax Increment Financing (TIF) is a tool that cities use to capture and dedicate a portion of the tax revenue generated by new development and increases in the value of existing development before that revenue is put in to the general fund. There is a linkage between this new development and the problem of displacement that make this a logical revenue source to utilize. Another political and policy advantage of a TIF is that the uses and the amounts of spending are locked in for a number of years. These uses do not have to compete annually with other City revenue demands. A TIF has a limited life, and after its life all the revenue reverts to the City as general revenue. 1. [Recommendation 92] Create TIFs in areas that are experiencing rapid development and along corridors that are slated for transit upgrades or city infrastructure investment. 2. [Recommendation 93] Adopt a policy that all new TIF districts, TIF life extensions or expansions of existing TIFs be required to dedicate 30% of the revenue to housing programs consistent with city housing goals and policies. As an example of the impact, if the Waller Creek TIRZ expansion had this requirement, Austin would have an additional $33 million for housing over the next 20 years. 25 3. [Recommendation 94] Require that TIFs sell bonds when financially feasible to bring forward future tax revenue to use for affordable housing today. This would permit the purchase of land or older apartments in rapidly re-developing areas before costs increase. C. Waive or reduce property taxes before they are collected. 1. [Recommendation 95] Property taxes for apartments are roughly 50% of total overall operating expenses. A fairer appraisal will reduce property owner resistance to providing affordable units. The city should work with the Travis County Appraisal District to develop a clear and equitable policy to so that rental developments with dedicated affordable units are appraised at a market value that accurately reflects explicitly foregone revenue attributable to lower rents in affordable units. 2. [Recommendation 96] Combine density bonuses with property tax abatements and negotiate with developers to secure more affordable units at lower rents. Density bonuses alone often fail to achieve rents affordable to lower income households but combined with additional incentives could make a significant contribution to preventing displacement for households with low incomes from Austin. Convince other local taxing jurisdictions, especially Travis County, to participate in this effort. D. Sell bonds to bring future tax revenue forward for investment today. 1. [Recommendation 97] Set a policy that for the next 10 years 20% of every GO bond election be allocated to housing. If Austin had this policy on the last 2 bond elections it would have allocated $329 million for housing bonds rather than $250 million. 2. [Recommendation 98] When scheduling bond sales and using those proceeds, direct the city staff to prioritize the use of bonds proceeds for housing. If the most recent $250 million in housing bonds are spent over 5-7 years, their impact on rapidly gentrifying areas of Austin will be greatly diminished. 3. [Recommendation 99] Throughout this report the Task Force recommends the city maximize the use of public funds for extremely long-term or preferably permanent affordability rather that short term benefits directed at households today. Historically investments in land and buildings with permanent affordability provisions, such as public housing have produced huge public benefits. If the city were to use a long-term “investment” approach more widely, it would benefit from bringing forward all available tax resources in order to invest in housing assets at today’s prices. II. Other sources of revenue. A. Developer incentives: ● density bonuses, ● fee-in-lieu; and ● units purchased at a discount for public ownership in private developments. 26 Austin should seek to maximize the amount of housing and the affordability of housing units produced for very low-income households when incentives are provided to developers. Developer incentives have the potential to provide the very important social benefit of affordability in places where privately funded residential development is occurring. The City must assess both how to encourage on-site affordable housing units that play a role in maximizing economic/demographic integration as well as how a payment and fee-in-lieu program or a program, like adopted in Montgomery County, MD providing public purchase of affordable housing in private developments, can be used to fund anti-displacement. A public purchase program would be most consistent with the aggressive long-term asset investment strategy that the task force recommends in this report. On-site units produced by the city’s existing density bonus program produces affordable housing in developments with market rate housing. It is critical that the units produced are affordable and appropriately sized for low-income families. This is not always the case in the way the program operates in Austin today however. The demographics of the tenants residing in the affordable units should be monitored and analyzed to ensure the units are actually rented to eligible households. Monitoring should also ensure that incentives are housing the priority targeted populations, i.e. households in the lowest income categories. The city should track whether housing units are created both in areas of high opportunity and in areas where units are required to offset displacement. 1. [Recommendation 100] The city council should ensure that the incentives provided to private developers maximize their contribution to affordable housing. Where to set density bonuses in terms of rent levels, affordability terms, type and size of units, on-site housing vs “fee in lieu” and terms for discounted public purchase of units in private developments for affordable housing are complex real estate investment calculations. These calculations change from project to project and with changing market conditions. The City Council should establish the Austin Affordable Housing Incentive Advisory Board, comprised of citizens and experts, to review developer incentives and advise the city council on needed adjustments each year. The investments being considered by the board along with prospectus and underwriting reports should be publicly disclosed in advance of decisions. Members of this advisory committee should be free from any conflicts of interest and subject to strict ethical standards. 2. [Recommendation 101] The city should extend density bonus fees-in-lieu to all new commercial development. 3. [Recommendation 102] The mayor’s strike fund for socially responsible real estate investors to support and preserve affordable housing should be aggressively marketed and pursued. B. Housing Trust Fund. 1. [Recommendation 103] The Austin Affordable Housing Incentive Advisory Board (described above in A.1.) should be responsible for reviewing and making recommendations to the city council on proposed expenditures from the Housing Trust Fund. 27 C. Other Tools and Sources of Revenue Austin needs additional tools and sources of revenue to fund affordable housing production and anti-displacement initiatives. Property tax revenue alone cannot provide the $4-$6 billion needed to address Austin’s affordable housing shortage. Unsubsidized apartment developments cannot bear the sole burden of providing affordable housing. The burden needs to be spread to all types of new development. 1. [Recommendation 104] Work with the Texas Municipal League and the mayors of large Texas cities to convince the Legislature to permit cities to adopt a reasonable, broad based housing linkage fee. Workforce and affordable housing are as much economic development issues as corporate incentives, and all major Texas cities face an affordable housing shortage. 2. [Recommendation 105] Work with other cities to secure authority from the Texas Legislature to permit cities to negotiate property tax waivers or reductions for projects that include affordable housing. 3. [Recommendation 106] Work with other cities to lobby the Legislature to restore the authority of cities to adopt inclusionary zoning. Texas is one of only three states that prohibit inclusionary zoning. 4. [Recommendation 107] The mayor should work with the appointed representatives on the public employees’ pension board to ensure the board prioritizes sound investments in affordable housing consistent with the City’s established goals and to avoid speculative investments that produce involuntary displacement. 28 A Note on the Task Force Charge of Addressing “Income and Asset Creation” Finding affordable housing is just one step in creating healthy families, communities and cities. The Task Force clearly understands that to stabilize the housing challenges, a city must be bold enough to provide comprehensive services and take a holistic approach to address the many problems that serve as an impediment to housing stability. Addressing needed services such as childcare, transportation, a basic retail sector, access to health care, and employment opportunities are all necessary to ensure long-term housing stability, however, we felt that the challenge was too great to tackle in the limited amount of time that the task force had to do its work. Since most of the expertise of task force members was in the housing arena, it seemed natural to play to this strength because it would yield recommendations that were insightful and actionable. Our decision to not address “Income and Asset Creation’ was not meant to devalue the importance of these strategies and their role in mitigating displacement. The section on “Preserving and Expanding Affordable Housing for Homeowners” includes a recommendation to establish an Office of Housing Stability that is intended to help individuals and families at risk of displacement to access programs and resources that can help stabilize their housing situation. This office could also serve as a vehicle by which individuals and families can access other programs and resources that support “income and asset creation,” such as child care, transportation, a basic retail sector, access to health care, and employment opportunities. 29 CONCLUSION The members of the Anti-Displacement Task Force want to thank the Mayor and city council members for allowing us the opportunity to serve on this task force. We also want to thank city staff who have shared data and information that have informed our reports. We are especially grateful for Austin’s concerned citizens who attended our meetings and public forums and spoken passionately and insightfully about Austin displacement problem. We have been deeply moved by their stories of loss of community, exclusion and displacement from the city they and their families have built over many years and love deeply. In addressing us, they have demanded that action be taken immediately to address displacement. As the Mayor’s and City Council member’s representatives on this task force we are mindful that ours is an advisory role. It is not within our power to give the citizens the actions they have so eloquently demanded — that is the job for Mayor and Council and the City Manager. It is time for our political leaders to lead Austin on the issues of displacement, gentrification and affordable housing with intention. These issues are not new. They have been discussed in Austin for many years while the problem accelerates and the situation of lower-income Austinites deteriorates. Good intentions and talk are no longer enough. What is needed now is bold leadership that challenges our citizens and businesses to act to do things differently and to make strategic sacrifices to build a diverse and inclusive Austin. We are reminded of the political risks that Congressman Lyndon B. Johnson took in the 1930’s to bring the controversial public housing program to our city in the face of fierce opposition from private real estate interests. This month the citizens of Austin have sent an overwhelming and clear message they are willing to take on this problem by voting 73 percent for an unprecedented commitment of a $250 million affordable housing bond issue. But this is only a first step. In a crisis like this, great leaders must lead citizens down a new path, one that is not exclusionary but is defined by the values of inclusion, diversity and integration for the benefit of all citizens. That is an Austin worth Imagining. We call on Mayor and City Council to take bold and immediate action to lead us there. 30 Minority Report Relating to the Potential Impact of Increasing the City’s Homestead Exemption Offered by Task Force Members: Raul Alvarez, Ann Teich and Ed Wendler, Jr The recommendation at issue may be found in the section of this reported entitled, “Expanding and Preserving Affordable Housing for Renters,” specifically Recommendation 51. The minority report pertains to the assertion relating to the impact of the homestead exemption on affordability and not on the balance of the overall recommendation. Task Force members signing this report take issue with the inference in this recommendation suggesting that efforts to increase the homestead exemption are a principal cause of our affordability crisis because it “shifts the tax burden to renters and small businesses.” A similar if not more convincing claim could be made regarding the fact that commercial properties in Austin are undervalued and that this fact has had a bigger impact on the affordability crisis for homeowners than the contrary suggestion in this particular recommendation of the Task Force report. Because extensive research and analysis would be needed to determine if either of the above claims have merit, the suggestion of this subset of the task force is that we not spend a lot of time and effort proving or disproving either claim. However, we do feel that a thorough analysis of the financial impacts of proposed changes to the City’s tax exemptions is crucial before such changes are made. In addition, having access to information about the tax exemptions available to homeowners in other Texas cities could help put these matters in the proper perspective. Our specific suggestions are that: 1. We recommend that Mayor and Council consider the full range of options relating to any changes to current or future homestead or senior exemptions. With regard to the Homestead Exemption, the Council should request that the City Manager conduct an analysis of how rental housing costs have changed since the City first began offering a homestead exemption for homeowners. With regard to the Senior Exemption, Mayor and Council should request that the City Manager conduct an analysis of the financial impact of: any proposed increases the senior exemption over the next 10 years with the financial impact that instituting a senior tax freeze would have over that same period of time; and increases to the senior exemption that have been instituted in the last 10 years and what the corresponding financial impact would have been of having instituted a senior tax freeze 10 years ago. 31 2. Mayor and Council request that the City Manager prepare a side by side comparison of Austin’s homestead and senior exemptions and the homestead and senior exemptions of the other 7 largest Texas cities. The impact of any changes to the City’s tax exemptions are complex and difficult to assess, but we do feel strongly that tax exemptions are an important tool for addressing the housing crisis. The information that we suggest be collected by the City Manager and considered by Mayor and Council would help to ensure that the information that is needed to make a decision that is informed by facts and not just claims that people presume to be true because they have been repeated over time.