20260114-002 November 2025 AAC Financial Memo — original pdf

Backup

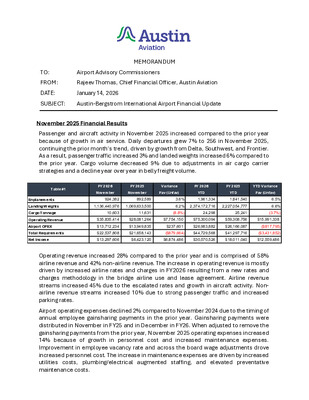

TO: FROM: DATE: MEMORANDUM Airport Advisory Commissioners Rajeev Thomas, Chief Financial Officer, Austin Aviation January 14, 2026 SUBJECT: Austin-Bergstrom International Airport Financial Update November 2025 Financial Results Passenger and aircraft activity in November 2025 increased compared to the prior year because of growth in air service. Daily departures grew 7% to 256 in November 2025, continuing the prior month’s trend, driven by growth from Delta, Southwest, and Frontier. As a result, passenger traffic increased 3% and landed weights increased 6% compared to the prior year. Cargo volume decreased 9% due to adjustments in air cargo carrier strategies and a decline year over year in belly freight volume. Table #1 FY 2026 FY 2025 Variance November November Fav (Unfav) FY 2026 YTD FY 2025 YTD Variance YTD Fav (Unfav) Enplanements Landing Weights Cargo Tonnage Operating Revenue Airport OPEX Total Requirements Net Income 924,382 892,589 3.6% 1,961,334 1,841,540 1,136,440,976 1,069,633,500 6.2% 2,374,172,716 2,227,054,777 10,603 11,631 (8.8%) 24,298 25,241 6.5% 6.6% (3.7%) $35,835,414 $28,081,264 $7,754,150 $75,300,094 $59,308,756 $15,991,338 $13,712,234 $13,949,835 $237,601 $26,983,882 $26,166,087 ($817,795) $22,537,808 $21,658,143 ($879,664) $44,729,568 $41,297,716 ($3,431,852) $13,297,606 $6,423,120 $6,874,486 $30,570,526 $18,011,040 $12,559,486 Operating revenue increased 28% compared to the prior year and is comprised of 58% airline revenue and 42% non-airline revenue. The increase in operating revenue is mostly driven by increased airline rates and charges in FY2026 resulting from a new rates and charges methodology in the bridge airline use and lease agreement. Airline revenue streams increased 45% due to the escalated rates and growth in aircraft activity. Non- airline revenue streams increased 10% due to strong passenger traffic and increased parking rates. Airport operating expenses declined 2% compared to November 2024 due to the timing of annual employee gainsharing payments in the prior year. Gainsharing payments were distributed in November in FY25 and in December in FY26. When adjusted to remove the gainsharing payments from the prior year, November 2025 operating expenses increased 14% because of growth in personnel cost and increased maintenance expenses. Improvement in employee vacancy rate and across the board wage adjustments drove increased personnel cost. The increase in maintenance expenses are driven by increased utilities costs, plumbing/electrical augmented staffing, and elevated preventative maintenance costs. Debt service cost increased 17% in November 2025 because a portion of the debt service cost in the prior year was offset by the application of the balance of interest earned from proceeds. Other requirements increased 6% because of an 8% increase in citywide allocated costs and increased transfers to the subordinate obligation fund from the initiation of the airport note purchase program in February 2025. Austin Aviation reported net income of $13.3M in November 2025, a 107% increase compared to November 2024. FY 2026 FY 2026 FY 2026 Budget vs. YTD Variance Budget vs. YTD Variance CYE vs. YTD Variance CYE vs. YTD Variance Table #2 Approved Budget - Seasonalized CYE - Seasonalized YTD $ Fav (Unfav) % Fav (Unfav) $ Fav (Unfav) $ Fav (Unfav) Operating Revenue Airport OPEX Total Requirements Net Income $73,019,133 $73,019,133 $75,300,094 $2,280,961 3.1% $2,280,961 $26,695,885 $26,695,885 $26,983,882 ($287,997) $44,486,583 $44,486,583 $44,729,568 ($242,985) (1.1%) (0.5%) ($287,997) ($242,985) $28,532,550 $28,532,550 $30,570,526 $2,037,976 7.1% $2,037,976 3.1% (1.1%) (0.5%) 7.1% Austin Aviation delivered favorable financial performance compared to the seasonalized FY2026 budget. Operating revenues exceeded the budget estimate primarily because of non-airline revenue performance resulting from strong passenger activity in November 2025. Total requirements are within 1% of budget expectations. As a result of favorable activity compared to the budget, net income is 7% above seasonalized budget estimate. Attachments: November 2025 - AAC Financial Report