20251112-002_1 Financial Report — original pdf

Backup

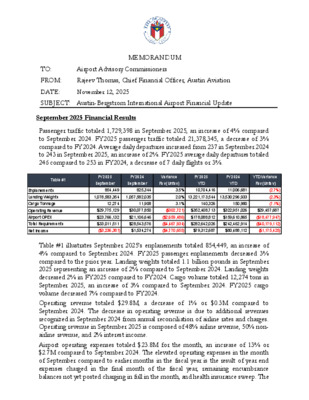

MEMORANDUM TO: Airport Advisory Commissioners FROM: Rajeev Thomas, Chief Financial Officer, Austin Aviation DATE: November 12, 2025 SUBJECT: Austin-Bergstrom International Airport Financial Update September 2025 Financial Results Passenger traffic totaled 1,729,398 in September 2025, an increase of 4% compared to September 2024. FY2025 passenger traffic totaled 21,378,345, a decrease of 3% compared to FY2024. Average daily departures increased from 237 in September 2024 to 243 in September 2025, an increase of 2%. FY2025 average daily departures totaled 246 compared to 253 in FY2024, a decrease of 7 daily flights or 3%. Table #1 FY 2025 FY 2024 Variance September September Fav (Unfav) FY 2025 YTD FY 2024 YTD Variance YTD Fav (Unfav) Enplanements Landing Weights Cargo Tonnage Operating Revenue Airport OPEX Total Requirements Net Income 854,449 825,344 3.5% 10,704,416 11,006,681 1,078,583,354 1,057,582,035 2.0% 13,221,173,544 13,530,296,933 12,274 11,908 3.1% 140,326 150,980 (2.7%) (2.3%) (7.1%) $29,775,129 $30,077,850 ($302,721) $352,408,713 $322,951,026 $29,457,687 $23,766,132 $21,106,646 ($2,659,486) $178,088,812 $159,610,865 ($18,477,947) $33,011,511 $28,543,576 ($4,467,934) $282,642,026 $242,462,914 ($40,179,112) ($3,236,381) $1,534,274 ($4,770,655) $79,312,687 $80,488,112 ($1,175,425) Table #1 illustrates September 2025’s enplanements totaled 854,449, an increase of 4% compared to September 2024. FY2025 passenger enplanements decreased 3% compared to the prior year. Landing weights totaled 1.1 billion pounds in September 2025 representing an increase of 2% compared to September 2024. Landing weights decreased 2% in FY2025 compared to FY2024. Cargo volume totaled 12,274 tons in September 2025, an increase of 3% compared to September 2024. FY2025 cargo volume decreased 7% compared to FY2024. Operating revenue totaled $29.8M, a decrease of 1% or $0.3M compared to September 2024. The decrease in operating revenue is due to additional revenues recognized in September 2024 from annual reconciliation of airline rates and charges. Operating revenue in September 2025 is composed of 48% airline revenue, 50% non- airline revenue, and 2% interest income. Airport operating expenses totaled $23.8M for the month, an increase of 13% or $2.7M compared to September 2024. The elevated operating expenses in the month of September compared to earlier months in the fiscal year is the result of year end expenses charged in the final month of the fiscal year, remaining encumbrance balances not yet posted charging in full in the month, and health insurance sweep. The increase in operating expenses compared to September 2024 is primarily driven by growth in airport staffing and increased contractual costs for information systems, building maintenance, and public safety (APD and ARFF). Because of the elevated expenses in the month of September, Austin Aviation reported a $3.2M deficit in September 2025, a decrease of $4.8M compared to September 2024. Fiscal Year 2025 Financial Results FY2025 Operating Revenue totals $352.4M compared to $323.0M in FY2024, a 9% increase. Airport Operating Expenses totaled $178.1M YTD in FY2025 compared to $159.6M in FY2024, a 12% increase. Net income totals $79.3M YTD in FY2025 compared to $80.5M in FY2024, a 2% decrease. Table #2 Operating Revenue Airport OPEX FY 2025 FY 2025 FY 2025 Budget vs. YTD Variance Budget vs. YTD Variance CYE vs. YTD Variance CYE vs. YTD Variance Approved Budget CYE YTD $ Fav (Unfav) % Fav (Unfav) $ Fav (Unfav) $ Fav (Unfav) 2.3% (0.8%) 0.1% 28.6% Total Requirements $282,849,317 $282,849,317 $282,642,026 $350,984,097 $344,510,644 $352,408,713 $1,424,616 $178,238,682 $176,738,682 $178,088,812 $149,870 $207,291 0.4% 0.1% 0.1% $7,898,069 ($1,350,130) $207,291 Net Income $68,134,780 $61,661,327 $79,312,687 $11,177,907 16.4% $17,651,360 Austin Aviation delivered favorable financial performance compared to FY2025 budget and current year estimate. As presented in Table #2, FY2025 revenues exceeded budget by $1.4M or 0.4% and current year estimate by $7.9M or 2.3%. The increase in revenue compared to budget and current year estimate results primarily from stronger than anticipated landing fee collections and differences in fees from original budget to published fee schedule. Airport operating expenses are less than 1% or $0.1M below budget and less than 1% or $1.3M above current year estimate. Austin Aviation reports net income of $79.3M, which exceeds the seasonalized budget estimate by 16% or $11.2M and exceeds current year estimate by 29% or $17.7M. In FY25, excess debt service reserve fund balance of $9.5M was released which also contributed to the favorable net income versus budget and current year estimate. Attachments: September 2025 - AAC Financial Report