20250813-002 Financial Memo — original pdf

Backup

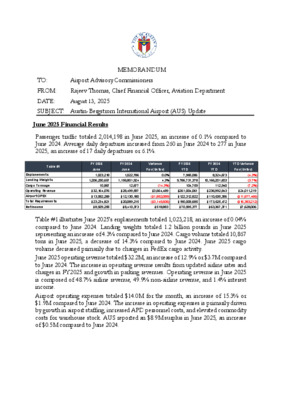

TO: Airport Advisory Commissioners MEMORANDUM FROM: Rajeev Thomas, Chief Financial Officer, Aviation Department DATE: August 13, 2025 SUBJECT: Austin-Bergstrom International Airport (AUS) Update June 2025 Financial Results Passenger traffic totaled 2,014,198 in June 2025, an increase of 0.1% compared to June 2024. Average daily departures increased from 260 in June 2024 to 277 in June 2025, an increase of 17 daily departures or 6.1%. Table #1 FY 2025 June FY 2024 June Variance Fav (Unfav) FY 2025 YTD FY 2024 YTD Variance YTD Fav (Unfav) Enplanements Landing Weights Cargo Tonnage Operating Revenue Airport OPEX Total Requirements Net Income 1,023,218 1,022,786 1,206,250,657 1,156,801,924 0.0% 4.3% 7,965,086 8,324,673 9,786,731,378 10,166,201,603 10,867 $32,164,076 $13,982,269 12,677 (14.3%) 104,759 112,940 $28,499,587 $12,130,180 $3,664,489 $261,004,061 $236,992,843 $24,011,219 ($1,852,089) $122,312,822 $110,635,356 ($11,677,466) $23,234,821 $20,089,215 ($3,145,606) $190,008,685 $173,625,472 ($16,383,212) $8,929,255 $8,410,373 $518,883 $70,995,377 $63,367,371 $7,628,006 (4.3%) (3.7%) (7.2%) Table #1 illustrates June 2025’s enplanements totaled 1,023,218, an increase of 0.04% compared to June 2024. Landing weights totaled 1.2 billion pounds in June 2025 representing an increase of 4.3% compared to June 2024. Cargo volume totaled 10,867 tons in June 2025, a decrease of 14.3% compared to June 2024. June 2025 cargo volume decreased primarily due to changes in FedEx cargo activity. June 2025 operating revenue totaled $32.2M, an increase of 12.9% or $3.7M compared to June 2024. The increase in operating revenue results from updated airline rates and charges in FY2025 and growth in parking revenues. Operating revenue in June 2025 is composed of 48.7% airline revenue, 49.9% non-airline revenue, and 1.4% interest income. Airport operating expenses totaled $14.0M for the month, an increase of 15.3% or $1.9M compared to June 2024. The increase in operating expenses is primarily driven by growth in airport staffing, increased APD personnel costs, and elevated commodity costs for warehouse stock. AUS reported an $8.9M surplus in June 2025, an increase of $0.5M compared to June 2024. Fiscal Year 2025 Financial Results FY2025 Year to Date (YTD) Operating Revenue totals $261.0M compared to $237.0M in FY2024, a 10.1% increase. Airport Operating Expenses totaled $122.3M YTD in FY2025 compared to $110.6M in FY2024, a 10.6% increase. Net income totals $71.0M YTD in FY2025 compared to $63.4M in FY2024, a 12.0% increase. Table #2 Operating Revenue Airport OPEX Total Requirements Net Income FY 2025 FY 2025 FY 2025 Budget vs. YTD Variance Budget vs. YTD Variance CYE vs. YTD Variance CYE vs. YTD Variance Approved Budget - Seasonalized CYE - Seasonalized YTD $ Fav (Unfav) % Fav (Unfav) $ Fav (Unfav) $ Fav (Unfav) $261,904,926 $256,213,076 $261,004,061 $123,164,551 $121,787,931 $122,312,822 $201,303,486 $200,676,866 $190,008,685 $60,601,440 $55,536,210 $70,995,377 ($900,865) $851,729 $11,294,802 $10,393,937 (0.3%) 0.7% 5.6% $4,790,985 ($524,891) $10,668,182 17.2% $15,459,166 1.9% (0.4%) 5.3% 27.8% AUS delivered favorable financial performance compared to FY2025 budget and current year estimate on a seasonalized basis. As presented in Table #2, FY2025 revenues are 0.3% or $0.9M below seasonalized budget because of decline in YTD passenger traffic compared to budget. Operating revenue exceeds current year estimate by 1.9% or $4.8M. Airport operating expenses are 0.7% or $0.9M below seasonalized budget and 0.4% or $0.5M above current year estimate. AUS reports net income of $71.0M, which exceeds the seasonalized budget estimate by 17.2% or $10.4M and exceeds current year estimate by 27.8% or $15.5M. Attachments: June 2025 - AAC Financial Report