Cultural Funding Worksheet — original pdf

Backup

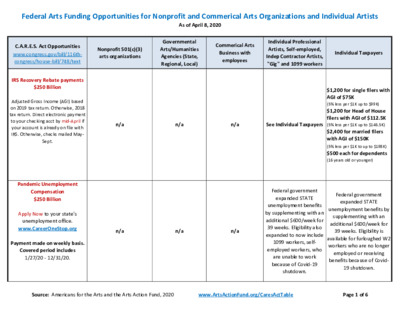

Federal Arts Funding Opportunities for Nonprofit and Commerical Arts Organizations and Individual Artists As of April 8, 2020 C.A.R.E.S. Act Opportunities www.congress.gov/bill/116th- congress/house-bill/748/text Nonprofit 501(c)(3) arts organizations Governmental Arts/Humanities Agencies (State, Regional, Local) Commerical Arts Business with employees Individual Professional Artists, Self-employed, Indep Contractor Artists, "Gig" and 1099 workers Individual Taxpayers n/a n/a n/a See Individual Taxpayers $1,200 for single filers with AGI of $75K (5% less per $1K up to $99K) $1,200 for Head of House filers with AGI of $112.5K (5% less per $1K up to $146.5K) $2,400 for married filers with AGI of $150K (5% less per $1K to up to $198K) $500 each for dependents (16 years old or younger) Federal government expanded STATE unemployment benefits by supplementing with an additional $600/week for 39 weeks. Eligibility also expanded to now include 1099 workers, self- employed workers, who are unable to work because of Covid-19 shutdown. Federal government expanded STATE unemployment benefits by supplementing with an additional $600/week for 39 weeks. Eligibility is available for furloughed W2 workers who are no longer employed or receiving benefits because of Covid- 19 shutdown. n/a n/a n/a Source: Americans for the Arts and the Arts Action Fund, 2020 www.ArtsActionFund.org/CaresActTable Page 1 of 6 IRS Recovery Rebate payments $250 Billion Adjusted Gross Income (AGI) based on 2019 tax return. Otherwise, 2018 tax return. Direct electronic payment to your checking acct by mid-April if your account is already on file with IRS. Otherwise, checks mailed May- Sept. Pandemic Unemployment Compensation $250 Billion Apply Now to your state's unemployment office. www.CareerOneStop.org Payment made on weekly basis. Covered period includes 1/27/20 - 12/31/20. Federal Arts Funding Opportunities for Nonprofit and Commerical Arts Organizations and Individual Artists As of April 8, 2020 C.A.R.E.S. Act Opportunities www.congress.gov/bill/116th- congress/house-bill/748/text Nonprofit 501(c)(3) arts organizations Governmental Arts/Humanities Agencies (State, Regional, Local) Commerical Arts Business with employees Individual Professional Artists, Self-employed, Indep Contractor Artists, "Gig" and 1099 workers Individual Taxpayers Employee and Retirement Benefits Extended Organizations with 50 or more but fewer than 500 employees, paid sick leave is extended to a minimum of 80 hours, regardless of length of employment. n/a n/a Companies with 50 or more but fewer than 500 employees, paid sick leave is extended to a minimum of 80 hours, regardless of length of employment. Paid Medical & Family Leave extended if you work for a business 50-500 employees. 10% Early distribution penalty waived for COVID-19 distributions up to $100K from retirement plans anytime during 1/1/20 to 12/31/20. Employer-share of 6.2% of FICA Payroll Tax Deferral interest-free for period 3/27/20 - 12/31/20. (Employee share must still be paid on time.) Only the employer share can be delayed. Payments must be made in 2 installments: * 50% on 12/31/20 * 50% on 12/31/22 n/a n/a Only the employer Self-employed individuals share can be delayed. Payments must be made in 2 installments: * 50% on 12/31/20 * 50% on 12/31/22 may delay payment of 50% of the SECA tax on self emplyment income. Payments must be made in 2 installments: * 50% on 12/31/20 * 50% on 12/31/22 Source: Americans for the Arts and the Arts Action Fund, 2020 www.ArtsActionFund.org/CaresActTable Page 2 of 6 Federal Arts Funding Opportunities for Nonprofit and Commerical Arts Organizations and Individual Artists As of April 8, 2020 Governmental Arts/Humanities Agencies (State, Regional, Local) Individual Taxpayers C.A.R.E.S. Act Opportunities www.congress.gov/bill/116th- congress/house-bill/748/text Nonprofit 501(c)(3) arts organizations Small Business Admin (SBA) Paycheck Protection Program Eligibility: Nonprofits with 500 or fewer W2 COVID-19 Emergency 7(a) Loan to Grant Program employees. Indepedent contractors not counted. $350 Billion Administered by: SBA-approved banks and lenders. Purpose: Keep your business running and retain as many W2 employees as possible with benefits up to 8 weeks. Loan Amount: Lesser of $10 million or 2.5 times the average total monthly costs for payroll salary, H/R benefits, overhead costs. Coverage includes payroll up to $100K/year salary per employee. to 6/30/20 Recommendation: Apply as soon as possible and get in the queue because funds are administered on a first come, first served basis. Loan Application: www.sba.gov/document/sba- form--paycheck-protection- program-borrower-application- form to 2 years. First 6 to 12 months of payment deferred. Entire loan forgiven by federal govt if you use at least 75% of loan for payroll and maximum of 25% of loan for overhead. Apply: Directly to banks beginning 4/3/20 Commerical Arts Business with employees Eligibility: Companies with 500 or fewer W2 employees. Indepedent contractors not counted. Loan Amount: Lesser of $10 million or 2.5 times the average total monthly costs for payroll salary, H/R benefits, overhead. Coverage includes payroll up to $100K/year salary per employee. Loan Terms: 4% Individual Professional Artists, Self-employed, Indep Contractor Artists, "Gig" and 1099 workers Eligibility: Expanded for the first time to 1099 independent contractors, self-employed workers, entrepreneurs Loan Amount: Lesser of $10 million or 2.5 times the average total monthly costs for your income, benefits, overhead costs. Coverage includes income up to $100K/year. Loan Terms: 4% interest up to 10 years. First 6 to 12 months of payment deferred. Entire loan interest. First 6 to 12 forgiven by federal govt if payment months you use at least 75% of deferred. Entire loan forgiven by fed govt if 75% of loan used for payroll and max of 25% of loan for overhead. loan for income and benefits and a maximum of 25% of loan for overhead. Apply: Directly to banks Apply: Directly to beginning 4/10/20 banks beginning 4/3/20 Eligible Covered Period: 2/15/20 Loan Terms: 1% interest up n/a n/a Source: Americans for the Arts and the Arts Action Fund, 2020 www.ArtsActionFund.org/CaresActTable Page 3 of 6 Federal Arts Funding Opportunities for Nonprofit and Commerical Arts Organizations and Individual Artists As of April 8, 2020 C.A.R.E.S. Act Opportunities www.congress.gov/bill/116th- congress/house-bill/748/text Nonprofit 501(c)(3) arts organizations Governmental Arts/Humanities Agencies (State, Regional, Local) Commerical Arts Business with employees Individual Professional Artists, Self-employed, Indep Contractor Artists, "Gig" and 1099 workers Individual Taxpayers Small Business Adminis. (SBA) Emergency Injury Disaster Loan (EIDL) Emergency 7(b) Loan Eligibility: Nonprofit 501 (c), (d), or (e) organizations in operation before 2/15/20 with $10 Billion Administered by: SBA directly online with a response in as little as 3 business days. Purpose: Business loan at low interest rate to cover debt and operating costs to keep your business running. EIDL loan must be repaid, but the first $10K advance is forgiveable if used to cover payroll or overhead. If you also secure a Payroll Protection loan, the $10K EIDL advance would first offset that PPP loan forgiveness by the same amount. Recommendation: Apply as soon as possible because funds are administered on a first come, first served basis. Loan Application: https://covid19relief.sba.gov/#/ fewer than 500 W2 employees. Indepedent contractors not counted. Loan Amount: Up to $2 million loan based on your company's credit score and specific COVID- 19 economic impact. Loan must be repaid, but the first $10K in emergency advance funds do not have to be Collateral: For loan amounts under $25K, no collateral requested. For loan amounts over $25K, collateral requested. Loan Terms: 2.75% interest up to 2 years. First 6 months of payment deferred. This is a loan that must be repaid. Apply: Directly to SBA online beginning 3/27/20. Eligibility: Companies in operation before 1/31/20 with fewer than 500 W2 employees. Indepedent contractors not counted. Eligibility: Expanded for the first time to 1099 independent contractors, self- employed workers, entrepreneurs Loan Amount: Up to $2 Loan Amount: Up to $2 million loan based on your company's credit score and specific COVID-19 economic impact. Loan must be repaid, but the first $10K in emergency million loan based on your company's credit score and specific COVID-19 economic impact. Loan must be repaid, but the first $10K in emergency advance funds do advance funds do not have not have to be repaid. Collateral: For loan under $25K, no collateral Collateral: For loan amounts amounts under $25K, no collateral requested. For loan amounts over $25K, collateral requested. requested. For loan amounts over $25K, collateral requested. Loan Terms: 2.75% interest up to 2 years. First 6 months of payment deferred. This is a loan that must be repaid. Apply: Directly to SBA online beginning 3/27/20. Loan Terms: 2.75% interest up to 2 years. First 6 months of payment deferred. This is a loan that must be repaid. Apply: Directly to SBA online beginning 3/27/20. repaid. n/a to be repaid. n/a Source: Americans for the Arts and the Arts Action Fund, 2020 www.ArtsActionFund.org/CaresActTable Page 4 of 6 Federal Arts Funding Opportunities for Nonprofit and Commerical Arts Organizations and Individual Artists As of April 8, 2020 C.A.R.E.S. Act Opportunities www.congress.gov/bill/116th- congress/house-bill/748/text Nonprofit 501(c)(3) arts organizations Governmental Arts/Humanities Agencies (State, Regional, Local) Commerical Arts Business with employees Individual Professional Artists, Self-employed, Indep Contractor Artists, "Gig" and 1099 workers Individual Taxpayers National Endowment for the Arts $45 million in direct NEA $30 million n/a n/a (NEA) @ $75 million $50,000 grants to nonprofit apportioned to COVID-19 supplement funding arts orgs, local arts state and regional arts agencies (LAAs) , cities, agencies by Individual professional artists can apply for individual grants from State and Local Arts or Humanities Agencies Some exceptions for direct individual grants from NEA and NEH Indirect benefit to taxpayers that will allow the government to partially support your community- based arts organizations to maintain staff, contracted artists, and operations so they can quickly re-open to serve the public with excellent arts programming after the Covid-19 pandemic. The National Endowment for the Guidelines posted: 4/8/20 Eligibility: Need to have been a previous NEA grantee within the last four years. Other COVID-19 Federal Culture Funding: Humanities (NEH) $75 million Services (IMLS) $50 million The Institute of Museum and Library The Corporation for Public Broadcasting (CPB) $75 million universities, etc. for general operating support with no matching grant to be used for payroll, contracted artists, and facility costs impacted by COVID. www.Arts.gov Note: FY19 & FY20 regular appropriations for these federal cultural agencies remain "project- specific" with matching gift requirements. However, some relaxed guidelines have been provided. www.arts.gov/COVID-19-FAQs population size for subgranting general operating, no match requirement grants to nonprofit arts organizations, local arts agencies, etc. to help cover payroll, contracted artists, and facility costs impacted by COVID-19. States will release their own guidelines for applying. Note: Local arts agencies (gov't and those appointed by gov't) are eligible to subgrant to communty- based nonnprofit arts orgs and their contracted artists. Source: Americans for the Arts and the Arts Action Fund, 2020 www.ArtsActionFund.org/CaresActTable Page 5 of 6 Federal Arts Funding Opportunities for Nonprofit and Commerical Arts Organizations and Individual Artists C.A.R.E.S. Act Opportunities www.congress.gov/bill/116th- congress/house-bill/748/text Nonprofit 501(c)(3) arts organizations As of April 8, 2020 Governmental Arts/Humanities Agencies (State, Regional, Local) Commerical Arts Business with employees Individual Taxpayers COVID-19 Relief Funds Have Been Created Across the Country A state-by-state list of community foundations and more grantmakers offering relief funds is available from the A state-by-state list of community foundations and more grantmakers offering relief funds is available Regularly check the Americans for the Arts Coronavirus Resource and Response Center: www.AmericansForTheArts.org/by- topic/disaster-preparedness/coronavirus- covid-19-resource-and-response-center Council on Foundations. https://docs.google.com/spre adsheets/d/e/2PACX- 1vT3YOH_tCxOTw1P0ZTdVnn GdNsULENdaZ36mUnL8TwN8x zgjQ3oXFaL93YYgrNHOTamHB 0Deagn3DGe/pubhtml from the Council on Foundations. 1vT3YOH_tCxOTw1P0ZT dVnnGdNsULENdaZ36m UnL8TwN8xzgjQ3oXFaL9 3YYgrNHOTamHB0Deagn 3DGe/pubhtml https://docs.google.com /spreadsheets/d/e/2PAC Eligibility is dependent on each foundation's X- guidelines. Eligibility is dependent on each foundation's guidelines. Individual Professional Artists, Self-employed, Indep Contractor Artists, "Gig" and 1099 workers A $10 million+ Artist Relief Fund created by multiple national foundations to support the emergency needs of individual artists with $5,000 grants: www.ArtistRelief.org Apply: Beginning 4/8/20 A state-by-state list of community foundations and grantmakers offering relief funds compiled by Council on Foundations. https://docs.google.com/spr eadsheets/d/e/2PACX- 1vT3YOH_tCxOTw1P0ZTdVnn GdNsULENdaZ36mUnL8TwN 8xzgjQ3oXFaL93YYgrNHOTa mHB0Deagn3DGe/pubhtml Charitable Giving Tax Deduction Incentives Expanded for tax year through 12/31/20 Charitable tax deduction created for non-itemizing taxpayers to donate up to $300 cash. Itemizing taxpayers can deduct cash donations up to 100% of AGI. Corps incentivized to donate up to 25% of their income. n/a See Individual Taxpayers The limit on corporations to contribute to charities increased from 10% to 25% of income. Incentives created for non- itemizing taxpayers to donate up to $300 in cash to charities. Itemizing taxpayers can now take a charitable tax deduction for cash donations up to 100% of AGI. Source: Americans for the Arts and the Arts Action Fund, 2020 www.ArtsActionFund.org/CaresActTable Page 6 of 6